Ten years ago, it would have been unthinkable for me to share my banking credentials so a third-party provider can access my financial data, no matter the benefit that might have resulted from that.

However, it’s about ten years since Open Banking began to emerge, allowing several million people and companies to benefit from innovative services with high added value.

Sharing access to financial data can allow customers to benefit from new, tailored services which meet real market needs – this is becoming more and more common, while the psychological barriers that may have existed in the past are being lifted.

These services, based on our technologies, allow consumers and businesses to:

- Better manage their money, spend wisely, or save further;

- calculate their carbon footprint according to their expenses or consumer habits, for instance;

- Finance long-term projects by saving smartly and automatically;

- Improve their purchasing power by benefiting from automatic cashback without even having to think about it;

- ensure companies’ sustainability thanks to cashflow forecasting solutions;

- exchange, pay, and get paid more easily with maximized security and reduced expenses;

- Access loans to achieve their project goals, even if their files do not meet all the requirements;

- Steer the management of their company, from accounting reconciliation to supplier payments, including salary payments.

Data sharing will be the norm

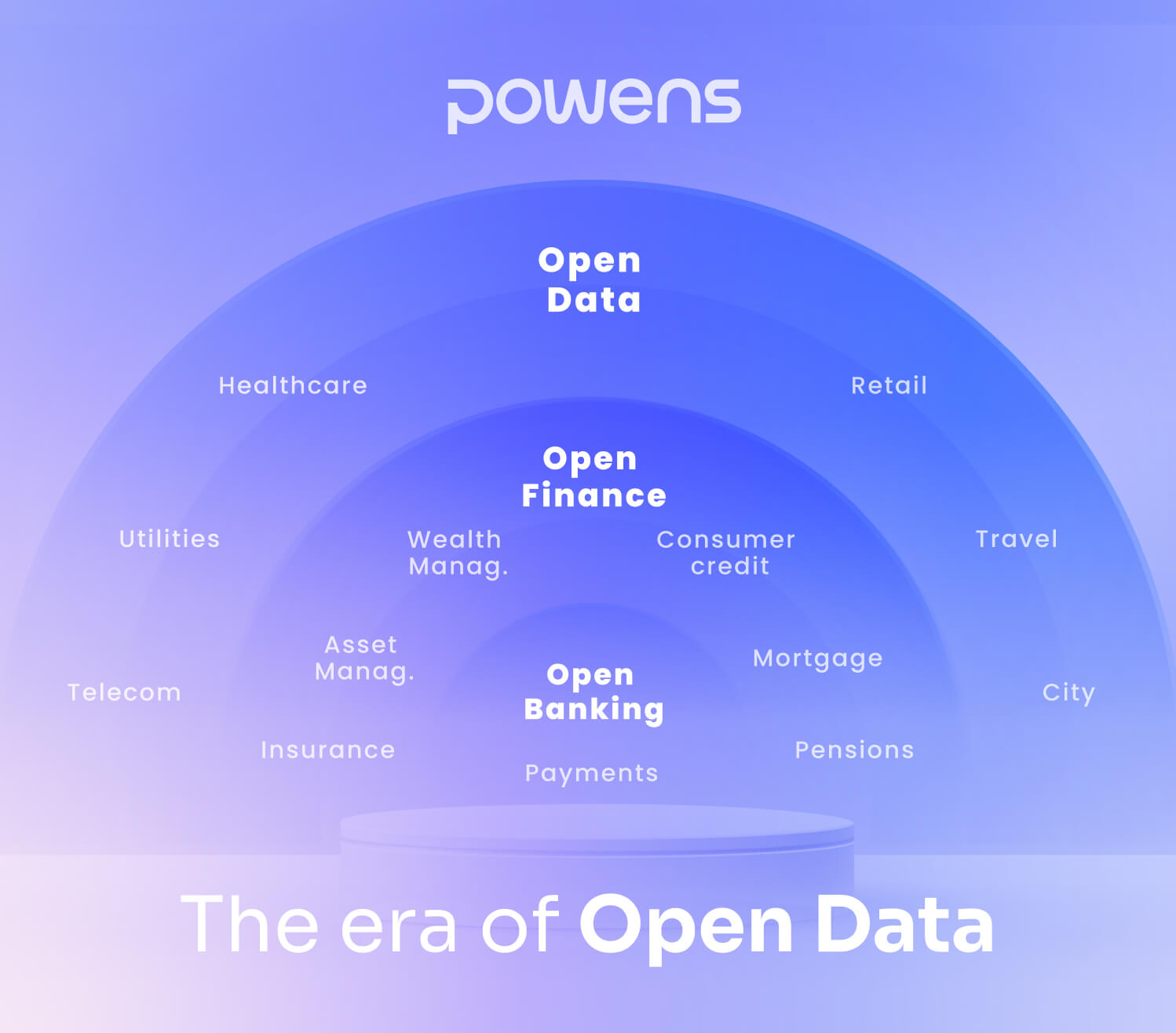

Fast-forward ten years, we see Open Finance entering the public conversation as payment account data (regulated by PSD2 in Europe) is not enough and it is absolutely necessary to cover all financial assets to offer a wide range of services.

The key benefit is pretty clear: the more data you have on a person or a company, the more relevant and valuable the service will be.

One thing is sure, this phenomenon will grow, and we will share increasingly more of our data with third parties, which will result in innovative services that make our lives easier, that are customized, and, ideally, less expensive.

Therefore, there is a growing belief that data sharing (financial or not) will become the global norm (if it is not so already).

Open Data is already a reality

Indeed, we already share our geolocation data to, for example, find out where the nearest restaurant is and how to get there as quickly as possible.

We share our different subscriptions (telecoms, streaming platforms, insurance, and so on) to get better offers. We even share our most confidential data, such as healthcare data, to get customized insurance instead of overpriced offers.

Regulation such as GDPR in Europe also favors this reality. This regulation has highlighted the fact that our data belongs to us.

Therefore, we must be able to retrieve and share it securely for an explicit purpose.

For now, this type of data sharing is not simple or as digitalized as it was made possible by the PSD2 for payment account data but, in time, it will occur naturally.

The needs of consumers and companies are naturally addressed by young innovative companies that, as we did ten years ago, have realized that the movement toward Open Banking represented the tip of the iceberg of a more powerful concept. Once innovation meets market success, then regulation adapts.

Innovation always precedes regulation, which is there to frame it, but above all to encourage it and therefore to encourage the emergence of data-sharing APIs.

Therefore, the main objective must be to reconcile openness and security.

Security: a crucial issue

Security is key. To share our data with third parties, we must have confidence in their ability to secure data exchange and storage.

In our case, PSD2 has reinforced our legitimacy by providing a legal framework for our activity (we are a payment institution regulated by the French national competent authority – ACPR) and by pushing for the use of secure APIs for data retrieval. Once trust was built, we saw a sharp increase in the use of our technologies.

Today, APIs are everywhere. In most IT systems and all industries, these programming interfaces facilitate the exchange of data and its availability to a wide audience, whether they are customers, partners, or employees.

Attacks on APIs are one of the most significant security threats today, as they provide direct access to sensitive data and functionality.

That’s why securing them is critical for companies like ours. To build trust and therefore use of our technologies, we have made security a key priority.

It has taken us many years to create a market (for Open Banking and Open Finance) that now makes life easier for millions of people and companies. A security breach could jeopardize the legitimacy and trust we have built over the past ten years. The stakes are high, and our investment is commensurate.

Therefore, we have entered the era of Open Data and, if we take Open Banking as an example, we can discover similar opportunities created by secure private data sharing.

The recipe for success lies in the digitalization and security of data exchanges, whether public or private. Once these two conditions are met and the use of this data meets an obvious need, a multitude of opportunities will be created, and many business models will be developed.

If you have any questions about the opportunities that Open Finance can bring to your business, feel free to reach out for more information.

Bertrand Jeannet, CEO of Powens

Contact us!

Your business needs are unique. Our answers should be too. Contact us today to get a personalized breakdown of how our technology can work for you.

Dec 19, 2022

Dec 19, 2022