A series of key product enhancements to make the overall Powens experience better for you and your end users

We’ve been busy the last quarter listening to your feedback and creating solutions to enhance your Powens experience. Here are our latest product and feature highlights:

Pay: Beta testing ‘Payment Links’ feature

A few of our customers have recently reached out to see if we could add a layer to our API in order to enable pre-populated wire transfers for instant payments via a clickable link. This would be akin to what you’ve likely done before when you click on a link—in an invoice or payment request—and then input your credit card details to finalize the transaction.

The user experience in this case is similar, in theory, with the main difference being that it would leverage Open Banking technology to allow end users to authenticate a connection to their checking account once, so that payment details would be pre-populated for all future transactions, thereby allowing end-users to pay with only a single click. The goal of this feature is to reduce payment times while also avoiding any kind of human error associated with the manual (and oftentimes incorrect) input of banking details. Not to mention, it would save businesses tons in credit card or wire transfer transaction fees as the Pay product levies a flat fee per transaction versus a percentage of the total amount.

The truth is, this is actually something we had considered doing in the past. But adding this API layer and creating a frictionless end user experience required overcoming a few hurdles. The biggest was developing a solution for keeping an API call open for more than 30 minutes—because we all know that just because an invoice with a link gets sent, there’s no guarantee that a customer will click on it and pay within a 30-minute window.

The good news is that our talented engineers have cracked the code and have now put this feature into beta testing with a few key customers who are working closely with our product team to battle-test the solution before we make it available to all Powens customers.

We plan to share more details once we finalize this round of beta testing. Stay tuned!

Pay: Expanded coverage in the Netherlands

One of our biggest goals as a company is to reach every corner of the European market with Powens solutions. Fortunately, we’re yet again one step closer to achieving this goal with the expansion of our Pay product in the Netherlands, where we now cover 98% of the market. Learn more about the coverage of all our products here.

Console: Two essential operational improvements

We’ve made a few updates to Console to create a better overall customer experience.

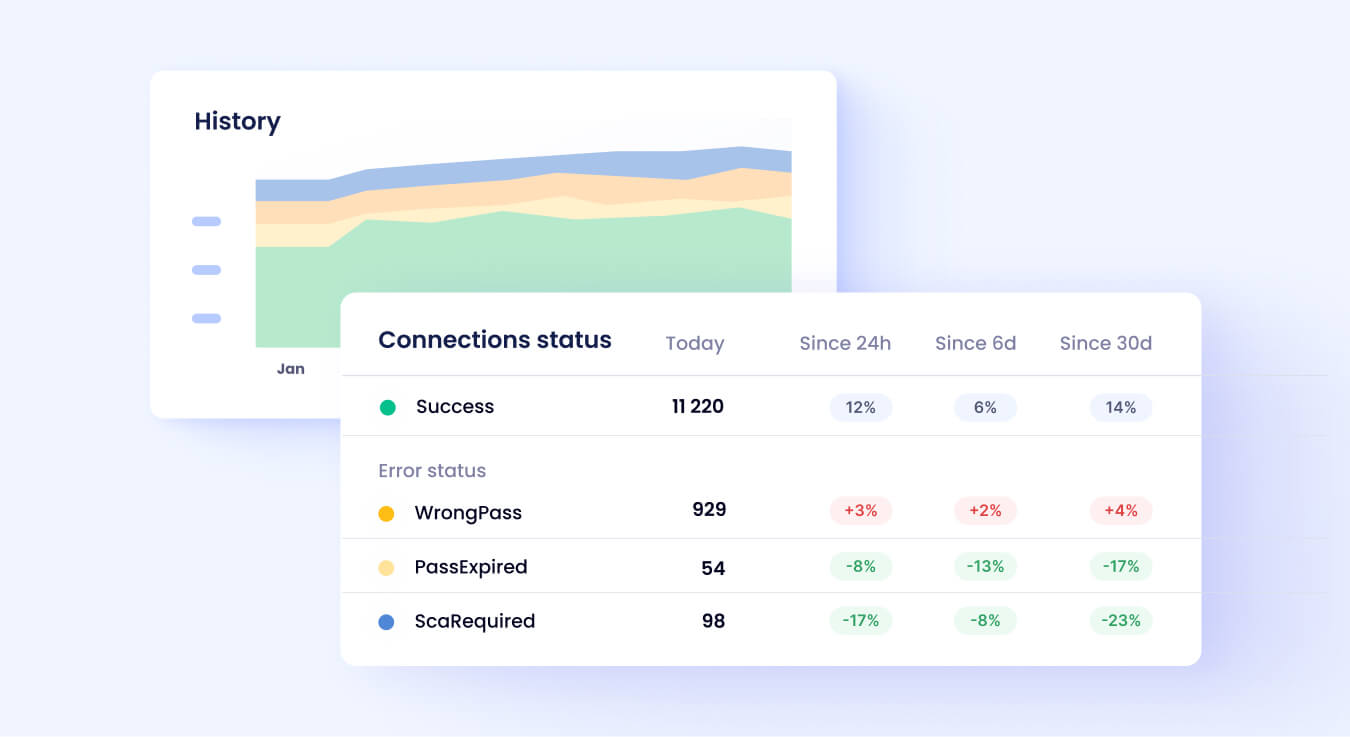

- Historical data: In the past, Console only provided access to a real-time view of the “health” of your API calls. However, we received lots of feedback from our customers about wanting access to data that not only sheds light on what’s working (or not) in real-time but also makes it possible to track performance issues over time. So now, we’ve made this available in the Console “Health Center” and, as a cherry on top, you can filter this data by bank to pinpoint trouble spots with granularity.

- Tailored communications: This update will be a welcome change for anyone who doesn’t like communication overload. We’ve created a way for our team to tailor the messages and updates your administrators receive from us (in Console) to the specific products you use or your specific use cases. So that basically means, when your admins get a message from us in the future, they better read it!

Webview: “Discreet mode,” IBAN display, and error messages

Based on feedback we’ve received from our customers, we’ve made some important updates to the Webview end user experience:

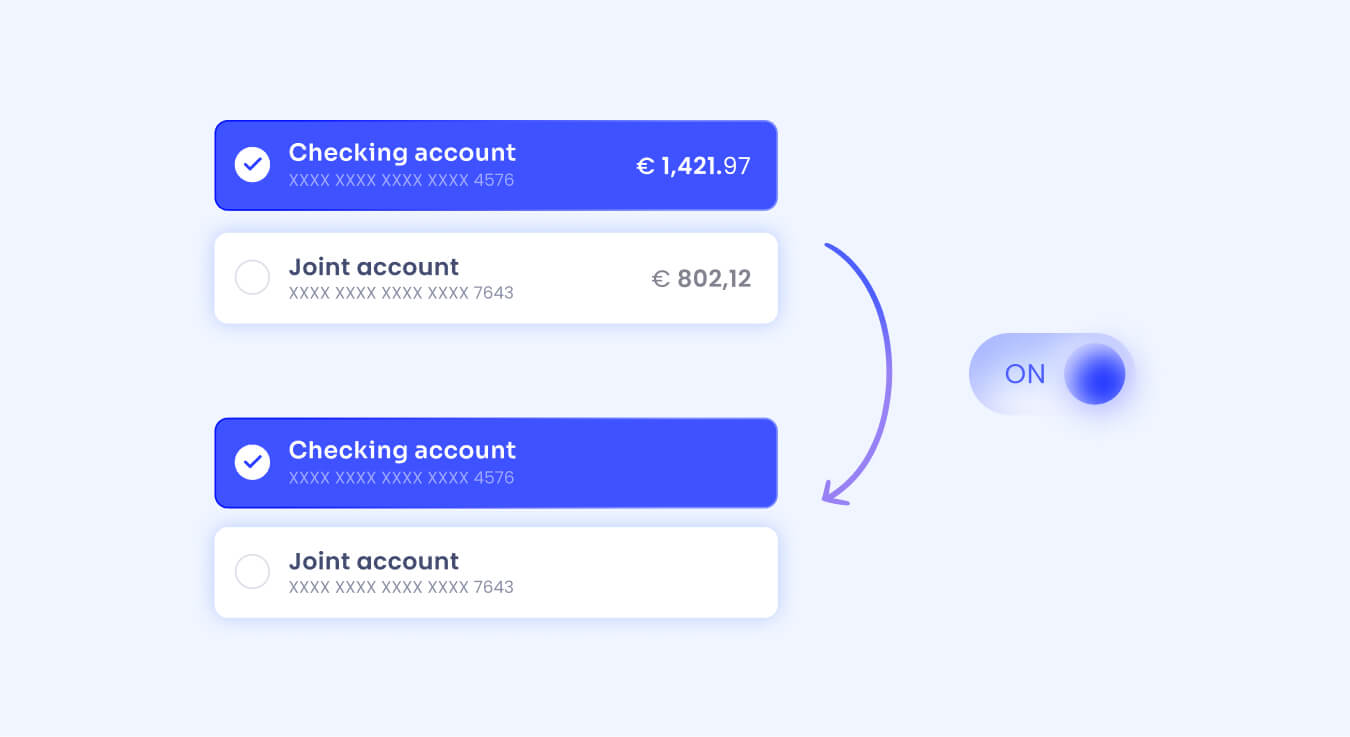

- “Discreet mode”: There are some Open Banking use cases that don’t require displaying an end user’s account balances when initiating an API connection (ex: identity verification for compliance purposes). Our customers have told us that this sometimes becomes a roadblock as end users go through the authentication process because they fear that, by authenticating, they’ll inadvertently give access to more data than actually what’s being requested of them—even though when using the Check product, a business would never get access to that kind of data anyway.To avoid any potential concerns around data over-sharing, when setting up your Webview parameters, you now have the option to select “discreet mode.” This will hide bank account balances from displaying in Webview during the authentication process and, as a result, should help calm some end user’s fears about data sharing.

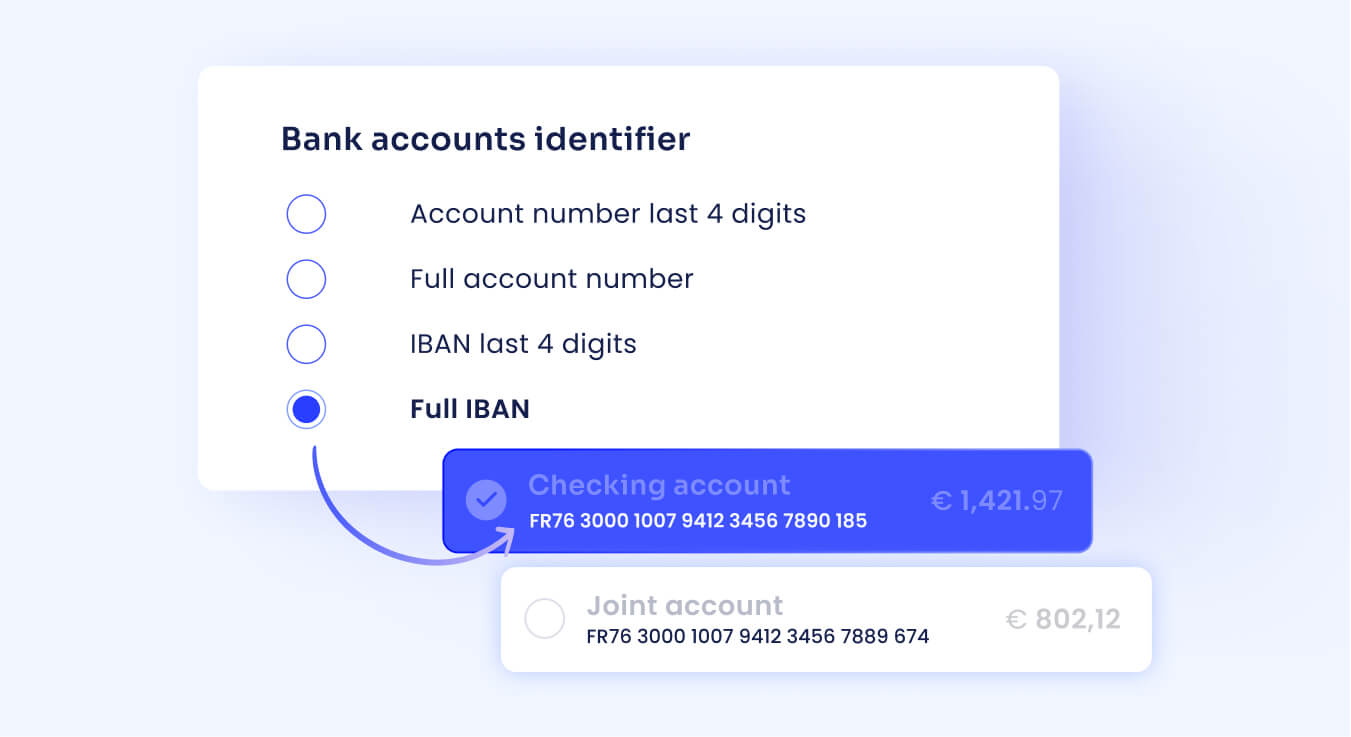

- IBAN display: When end users go through the consent process, if they have a various bank accounts associated with a single bank—but no of way differentiating between them all, if the account or IBAN numbers aren’t displayed—this can create yet another roadblock. So, to avoid this from happening, we’ve made it possible to customize Webview based on your specific use case, including displaying the last four digits of an end user’s bank account or IBAN number to make it easier for them to choose which bank account to select during the consent process.

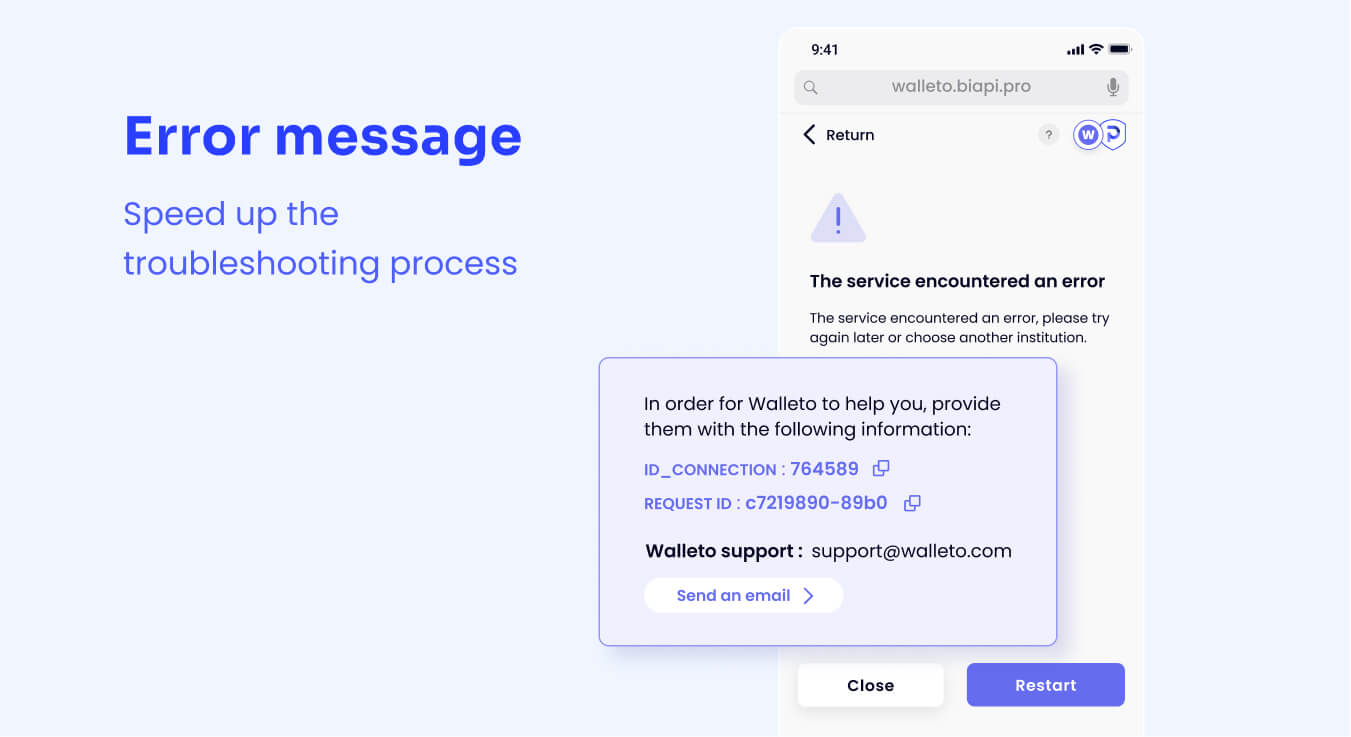

- Error messages: We’ve recently changed the way we display error messages whenever an end user can’t connect to their bank. Instead of simply display the error message, it is now accompanied by an error number that the end user can provide to the customer support team to help speed up the troubleshooting process.

Trust: Automated document retrieval and address extraction

In Q1, we moved up the launch of a major update to Trust, enabling a business’s ability to retrieve identity verification documents (as PDFs) directly from the source—utilities providers, telecom companies, and administrative services—without having to rely on end users to upload those documents manually. Not only does this enable faster identity verification, but more importantly, it also ensures that the documents provided to you have not been altered in any way. This creates an inherently more secure way to confirm identity.

While that alone was a big leap in terms of speed and efficiency, we decided to take that one step further. Our latest update makes it possible for our customers to obtain the end-user’s first name, last name, and postal address in a structured format—directly from the API.

The benefit here is simple: It eliminates the need for you to manually input address details (from the abovementioned PDFs) into your own tools for the purpose of verifying the accuracy of the information provided. This means that you now have a fully automated way to collect and verify identity information without having to rely solely on manual user data entry or via PDF documents.

Apr 12, 2023

Apr 12, 2023