- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Expand your business with

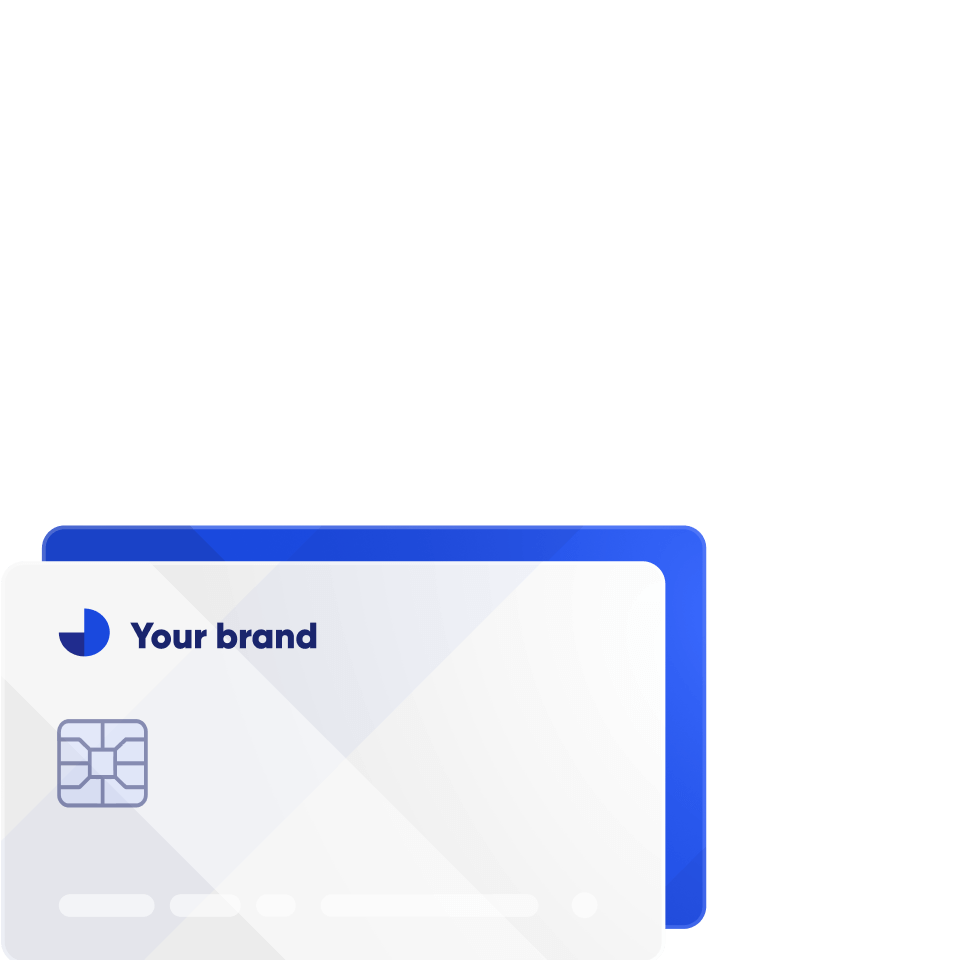

your own branded Visa debit cards

Our card issuing service allows you to customize Visa debit cards with your brand, providing customers - whether individuals or businesses - with a unique experience while strengthening their connection to your business.

We manage the complexity for you

Issuing cards can be a long, complex and very bureaucratic process. We handle everything to deliver your customized cards quickly and easily

Protected funds

Thanks to the backing of an Electronic Money Institution, the funds held in our accounts will always be safeguarded.

Regulatory compliance

You do not need a BIN Sponsor or to obtain a license. We cover all the regulatory needs for issuing your cards.

Key Features

Your brand, your card

Personalize our Visa debit cards with your brand. Use them for physical and online payments anywhere in the world.

Virtual or physical

Create virtual and/or physical cards according to your needs. Benefit from our advanced features, such as spending limits, block and unblock management, enable and disable contactless payment, etc.

Contactless payments

Our cards can be integrated with Google Pay and Apple Pay, allowing your customers to pay securely from their Android or iOS devices.

Dedicated BIN range

If you wish, we can help you to obtain a Bank Identification Number (BIN) exclusively for your business. This will allow you to customize your 3D Secure screen and your SMS notifications, among other features.

How it works

Start issuing cards with a simple and 100% digital process:

// Balance Information returns card and account balance information needed by DE to create a decision.

func (service *Card) BalanceInformation(

ctx context.Context,

request *cmsrpc.BalanceInformationRequest,

) (*cmsrpc.BalanceInformationResponse, error) {

card, err := service.validateCard(request.GetProductID(), request.GetCardID())

if err != nil{

return nil, commonrpc.HandleStatusError(err, "validating card failed")

}

account, err := service.validateAccountRPC(ctx, request.GetProductID(), card.AccountID)

if err != nil{

return nil, commonrpc.HandleStatusError(err, "validating account failed")

}

return &cmsrpc.BalanceInformationResponse{

Balance: account.Balance,

BlockedAmount: account.BlockedAmount,

}, nil

}|

1

Project Scope Definition

Define your design and delivery methods: Choose how you want to customize your cards and the shipping methods available to your customers.

2

API Integration

Our technical team will provide you with the necessary support to integrate our solutions with your platform.

3

User Registration

Go to production and register your users: Once everything is configured, you can launch your cards to the market and register your users.

4

User activation

Activate and send the cards to your users: Your customers will be able to activate the cards received and start enjoying the benefits quickly and easily.

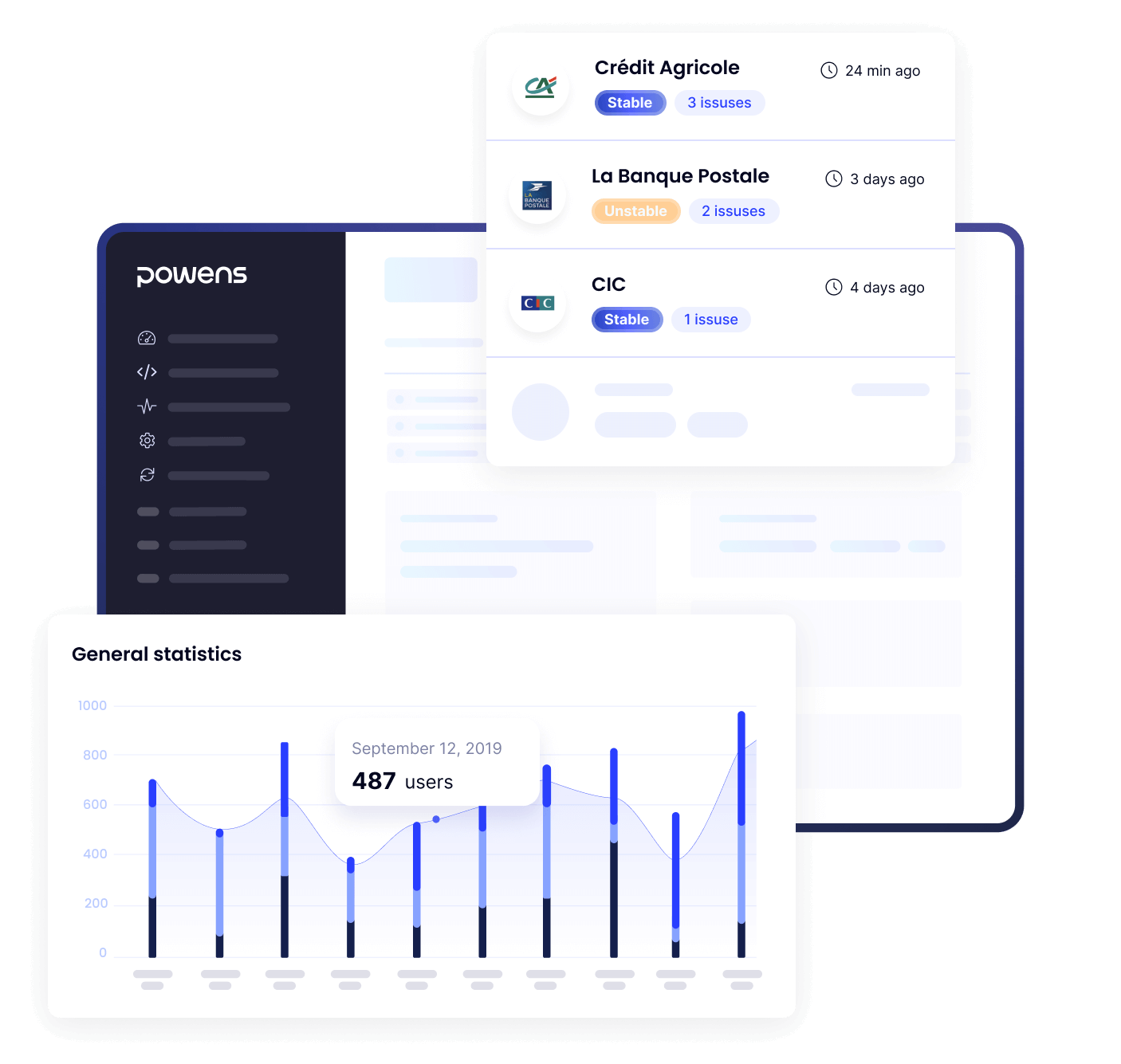

Powens’ console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statuses.

Create an account and let us guide you

Setup a free sandbox in just a few clicks and use the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Check bank sync usage and keep an eye on health status reports.

Analyze

Visualize key metrics & trends to optimize your Open Finance experience (amounts, users, conversion rates...).

Powens by the numbers

2012

Expertise

260+

Clients

7M+

End-users

1.2B+

API Calls

1.3B+

Payments

IBAN, payment solutions and card issuing are provided by Unnax Regulatory Services EDE, S.L. under its electronic money license (Bank of Spain registration code 6719). The card issuing service is offered through its partnership with Wallester AS, a payment institution duly registered in Estonia.