The Complete Guide to Understand Open Banking, Open Finance, BaaS & Embedded Finance

For non-financial services companies, financial services terms can be difficult to differentiate.

While Open Banking, Open Finance, BaaS, and Embedded Finance may have similarities, each term has a distinct meaning and role within the financial services market. Understanding these differences is the key to finding technology providers that align with your business’s needs.

Moreover, clear comprehension of these terms helps you better communicate your current technological status and the improvements you hope to achieve with your chosen providers.

Read on for your complete guide to Open Banking, Open Finance, BaaS, and Embedded Finance.

What is Open Banking?

Open Banking refers to specific regulatory standards, with the two most well-known regulations being the UK’s Open Banking Standard and the European PSD2 regulation.

These regulations mandate the use of technologies that allow third-party services to gain access to financial data (primarily bank account, payment, and transaction data). A core requirement is consumer consent, without which financial data cannot be legally shared between different entities.

According to Deloitte’s 2024 banking and capital markets outlook, Open Banking regulations have increased both financial data accessibility and the selection of personalized offerings for customers.

Perhaps most importantly, Open Banking regulations set clear expectations for financial data sharing, enabling smooth integrations of digital services like Embedded Banking and Embedded Finance.

What is Open Finance?

Open Finance is an initiative that aims to increase financial data accessibility across a much broader range of products and services, including investments, insurance, savings accounts, and pensions. Thus, Open Finance represents the natural evolution of Open Banking.

The increased data access that Open Finance proposes places greater emphasis on the importance of APIs, as seamless integrations are a necessity for ensuring effective communication between consumers, financial institutions, and third-party service providers.

While still in its early days, Open Finance is making regulatory waves. In March 2024, the Financial Sector Conduct Authority (FSCA) proposed seven key Open Finance policy recommendations:

- Establishment of a regulated Open Finance regime

- Tailored and proportionate regulatory oversight for Open Finance participants

- Mandated explicit informed consent when using consumer data

- Development of appropriate risk management and disclosure frameworks

- Development of data protection and data sharing standards

- Increased consumer awareness and recourse mechanisms

- Establishment of an Open Finance Advisory Group

What is BaaS?

BaaS (Banking-as-a-Service) is a software solution that provides non-financial companies with an effective regulatory and technological infrastructure for banking services.

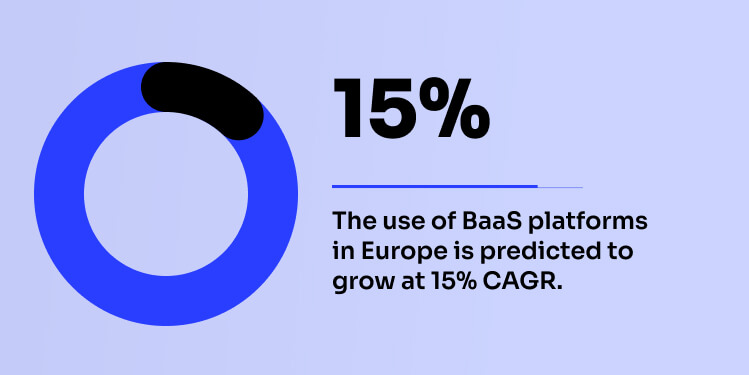

Over the next decade, Future Market Insights predicts that BaaS platform usage in Europe will grow at 15% CAGR. By 2034, the European BaaS industry is poised to hit a value of over $36M.

Leveraging BaaS solutions enables non-financial businesses to greatly reduce their regulatory burden by allowing them to establish partnerships with licensed technology providers.

What is Embedded Finance?

Embedded Finance is the integration of financial services into digital platforms and applications. Both Open Banking and BaaS play essential roles in enabling Embedded Finance, as they provide the data-sharing capabilities and infrastructure support needed for its integration.

For non-financial companies, Embedded Finance products can enhance end-user customer experiences. Additionally, they provide the opportunity to generate new revenue and lower implementation costs for non-financial companies who want to offer financial products.

A sub-set of Embedded Finance is Embedded Banking, a specific service designed to integrate traditional banking products and services into a digital ecosystem, such as payment services.

A Embedded Banking platform enables the integration of banking capabilities into non-banking platforms, including:

- Digital accounts

- Payment solutions

Both Embedded Finance and Embedded Banking offer the benefits of scalability and regulatory support.

Develop tailored Embedded Banking products with Powens

Powens is the only platform that brings together Open Finance and Embedded Banking with the mission to empower financial institutions, fintechs, and software vendors across Europe & LATAM to create innovative products and streamline their financial operations through frictionless and fully automated banking and payment experiences.

Jun 12, 2024

Jun 12, 2024