Get ready for summer because we’re releasing a host of new products to enhance financial aggregation and improve B2B services.

Updates to Bank Advanced: Introducing LCR connectivity

Available in France

Last winter, Powens’ Bank Advanced product was released, providing a cutting-edge module for SMEs to obtain richer data in their financial management software.

Through Bank Advanced, our business software customers can now retreive their users’ transactions’s attachments and invoices from neobanks such as Qonto, Shine, or manager.one, as well as Payment Service Providers (PSP) such as Stripe, Paypal or Sum Up, bringing bank reconciliation to the next level.

Now, we have updated the features of this product once again with the addition of a new financial document: the LCR (exchange statements).

LCRs are a type of document, like an invoice of exchange orders for a customer (the drawee) to pay the corresponding invoice amount, on the date indicated, to his creditor (the drawer).

*LCR are only available on 2 banks in France at the moment.

Wealth enters the B2B space

Available in France

Previously available only for B2C wealth management platforms, our Wealth product is now available for ERPs and accounting softwares, we added the retrieval of business savings and business loans.

Wealth Pro allows SMEs to connect their company savings and loans to their business management software banks, further facilitating corporate cash management and accounting in a context of high interest rates.

As the trusted Open Finance provider of Europe’s top B2B financial management software (Pennylane, Qonto, Agicap), Powens once again leads the way to unlock growth for European SMEs, by powering a more efficient use of their financial data.

Enabling joint account readings via Account Check

Available in France

At Powens, we are currently the only provider in French markets offering an identity check solution for co-jointed accounts. Typical account identity verification solutions allow only one account user to complete the authentication process.

With our recent update to our Account Check, when available, all the parties who have a role on an account. For example, if a person’s significant other shares authorization of their checking account, both parties must share their consent before account reading or information retrieval can occur.

For use cases like lending and BNPL services where lenders must verify the authorization of all account owners, our Check solution for co-jointed accounts can provide frictionless onboarding and efficient verification in a fully compliant workflow.

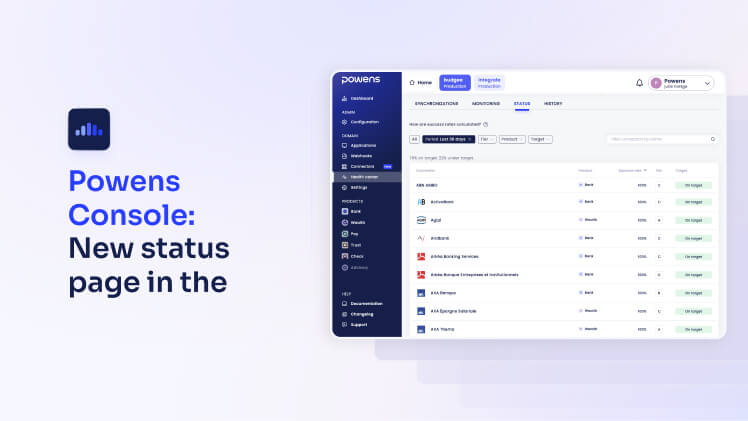

New status page in the Powens Console

Available in France

With great excitement, we are introducing a new status page in the Powens console. This new feature allows you to monitor the adding success rate of each connector over the last hour, day, and month.

The new status page empowers your support team to:

- Easily identify underperforming connectors

- Streamline communications with end-users

- Facilitate faster issue resolutions

In the upcoming weeks, we plan to further enhance this new status page by adding more detailed information, such as the success rate of specific account types of each connector like current account and investment account.

Additionally, all connectors will be organized by tiers, enabling you to determine their quality of performance according to their respective tier with greater ease.

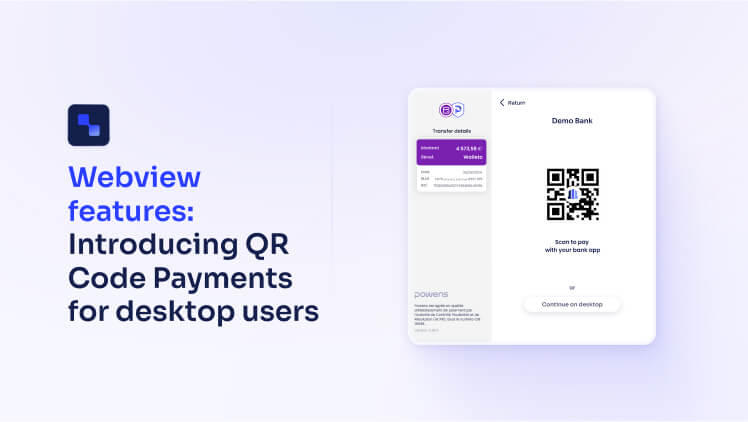

Webview features: Introducing QR Code Payments for desktop users

Available in France

After speaking with clients, we noted one particular feature for Webview that ranked high among requested future features: QR code payments for desktop users.

With QR code payments designed for desktops, users can easily access and scan a QR code with their smartphone which redirects them to their personal or business bank’s mobile app interface. The addition of this feature to the Powens platform ensures a simplified payment process, as end-users no longer need to navigate to their bank’s desktop interface, remember their login ID and password, and manually enter their authorization credentials.

These new QR code payments for desktops allow users to authenticate themselves using biometric verification measures, such as face or touch ID. The addition of this feature to Powens’ Webview solution can help our clients achieve both a smoother user experience and higher conversion rates.

Account Ownership Verification through API in Spain

Only available in Spain

For companies in Spain, we have launched our Account Ownership Verification solution this year. Our Account Ownership Verification solution authenticates the identity of a customer and confirms they own the bank account they are claiming without direct user interaction. This validation is not done via Open Banking but through a direct connection with IBERPAY, the entity managing the National Electronic Clearing System in Spain.

We leverage an API-based approach to Account Ownership Verification to promote seamless authentication and authorization processes. As an API, this solution can integrate directly with many back-office systems, such as CRMs, ERPs, and TSMs.

The Account Ownership Verification solution allows:

- To validate Spanish IBANs: Validate the ownership of +75 million accounts with Spanish IBANs, both for individuals and businesses.

- Batch queries: Make individual or batch requests depending on business needs.

- Fully digital experiences: Leverage a fully digital experience via direct API connections to your back office for automating responses.

- Real-time availability: Receive responses in seconds, 24/7.

Many use cases can benefit from our Account Ownership Verification solution, such as account opening, loan processing, payment verification, and more — the possibilities are truly endless.This service is linked to payments initiated from IBAN accounts issued by Unnax, our sister company.

Take advantage of features exclusive to Powens

The Powens platform provides the unique advantage of both Open Finance and Embedded Banking capabilities. Our mission aims to empower financial institutions, fintechs, and software vendors across Europe and LATAM with innovative products.

With Powens’ innovative approach, our clients can streamline their financial operations through fully optimized and automated banking and payment experiences. Get in touch with our specialists to learn more about our Open Banking, Open Finance, and Embedded Banking solutions.

Jul 22, 2024

Jul 22, 2024