Monitoring cash flow in today’s digital ecosystems requires real-time visibility. While many financial management software platforms already use Open Banking technology, not all systems achieve the seamless accessibility and reliability needed to maximize efficiency.

Real-time oversight is crucial for informed financial decisions and maintaining a healthy liquidity position. For financial software platforms, direct access to real-time bank data is no longer a luxury but a necessity to enhance client experiences.

Why is real-time cash flow monitoring vital for financial software management companies?

Cash flow management tools must establish direct, stable, and reliable connections with banks.

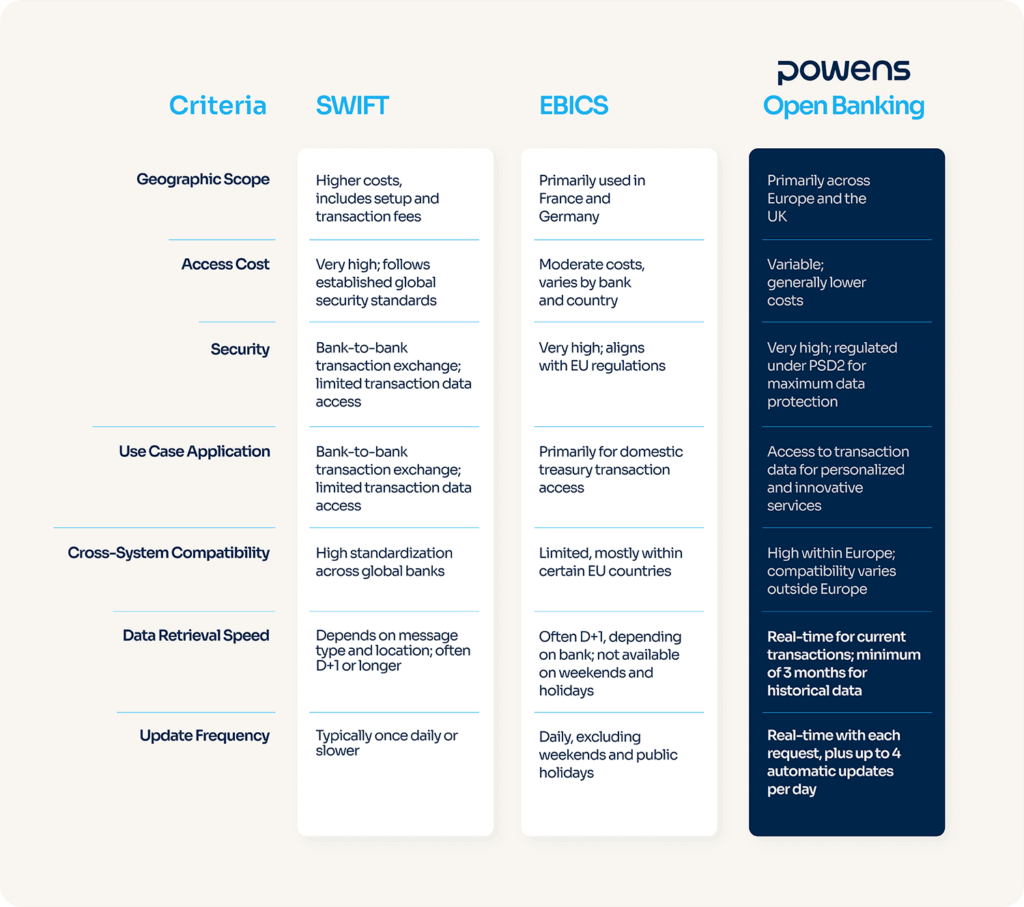

Modern banking protocols like SWIFT and EBICS, prevalent in countries like France and Germany, have streamlined many processes but still face limitations that integrated solutions address more effectively.

While SWIFT and EBICS offer quick, often instantaneous connections, challenges in data stability, historical data access, and scalability hinder seamless real-time cash flow monitoring.

For instance, retrieving historical data through these protocols can be time-consuming, whereas integrated solutions centralize past and current data in a single, real-time view. This advantage is crucial for compliance, auditing, and forecasting purposes.

Additionally, scaling with SWIFT or EBICS connections often requires unique compliance and contractual steps per bank, adding to the administrative load. Integrated solutions, by contrast, simplify these requirements, allowing financial software platforms to expand connections effortlessly.

Given these hurdles, financial software platforms need real-time, stable integration that not only enhances data access but also minimizes complexity, paving the way for agile, comprehensive cash flow oversight.

You’ll like: Real-Time Bank Reconciliation for Financial Management Software

How does Powens’ Bank Solution enhance cash flow monitoring across Europe?

Powens offers financial software platforms a reliable, direct, and seamless connection to bank data across Europe, addressing the limitations of traditional banking protocols. Our API ensures enhanced stability, reducing integration complexity. Financial software providers can efficiently connect to multiple bank accounts, enabling a comprehensive, real-time view of cash flows.

Our solutions also minimize integration time. What typically takes weeks or even months can be set up swiftly, giving platforms the flexibility to manage multiple bank connections effortlessly. This efficiency not only enhances the client experience but also simplifies the entire cash flow management process.

Additionally, our solutions go beyond cash flow monitoring. With Powens’ Wealth Pro feature, financial software platforms can offer clients visibility into a broader range of financial assets, not just current accounts. This holistic view includes investments and other financial instruments, providing deeper insights into overall financial health.

Powens in Action: Agicap’s Success Story

Consider Agicap, an online cash management software that automates cash tracking. With Powens’ Open Banking technology, Agicap powers real-time tracking by continuously updating customer bank transactions, invoices, and balances. Using Powens’ Bank solution, Agicap has attracted over 6,000 customers across Europe, benefiting from an aggregated, single-interface view of cash flows with real-time visibility.

“Open Banking still presents many opportunities and challenges for us in the future. Powens is actively working to influence future regulatory standards on which we are ultimately building our business. We are fortunate that our European growth and roadmap ambitions are aligned.”

Jérémie Barbet, deputy CPO, Agicap

How does Powens integrate with existing financial software and systems?

Powens’ API simplifies integrations and improves the developer experience for our clients. Basically, if you’ve integrated APIs before, you will find it very easy to integrate our API.

We offer thorough online documentation that allows our clients to act autonomously when integrating our technology, as well as a specific and dedicated Powens specialist assigned to each client at all times. During integration, a solution engineer schedules meetings with the client to explain how the API works. After the integration is complete, Powens assigns each Key Account Manager (KAM) to each client for ongoing support.

Additional customer support services offered by Powens includes:

- A console where the client can set up specific technical requirements during the integration and provide a view of consumption of the APIs (for example, how many transactions did a client retrieve, or how many bank accounts per user).

- Online support where clients can open tickets for the Powens team to review and respond to. Once a ticket is submitted, the Powens team reviews the support request quickly and determines whether the issue requires technical help from one of our developers.

- For any needs not covered by the Powens API, we provide access to our product management team to help customize each client’s solution to their specific needs.

From a functional perspective, what we are ultimately offering is the ability to integrate with many banks at once, allowing clients to retrieve transactional data from multiple accounts, multiple times per day.

Powens not only provides a strong operational foundation via technical integration but also a seamless experience for end-users, creating an undeniable advantage for financial software who need the ability to enhance financial oversight for their clients.

Experience true efficiency and real-time monitoring with Powens

Powens’ Bank Solution provides instant access to detailed banking data, including current balances, transactions, and historical data. Our user-friendly admin dashboard is designed to lessen your overall developmental burden and ensure you have a central hub for core functions, from configuring domains and client applications to monitoring the status of connections.

With connectivity to over 1,800 banks, neobanks, and payment service providers, we empower your financial management processes with our proven Open Finance expertise. Start building your competitive advantage with Powens today.

Nov 11, 2024

Nov 11, 2024