Our first product release of 2025 is here, focusing on enhancing fraud prevention and expanding our payment solutions.

Introducing New Data Insights

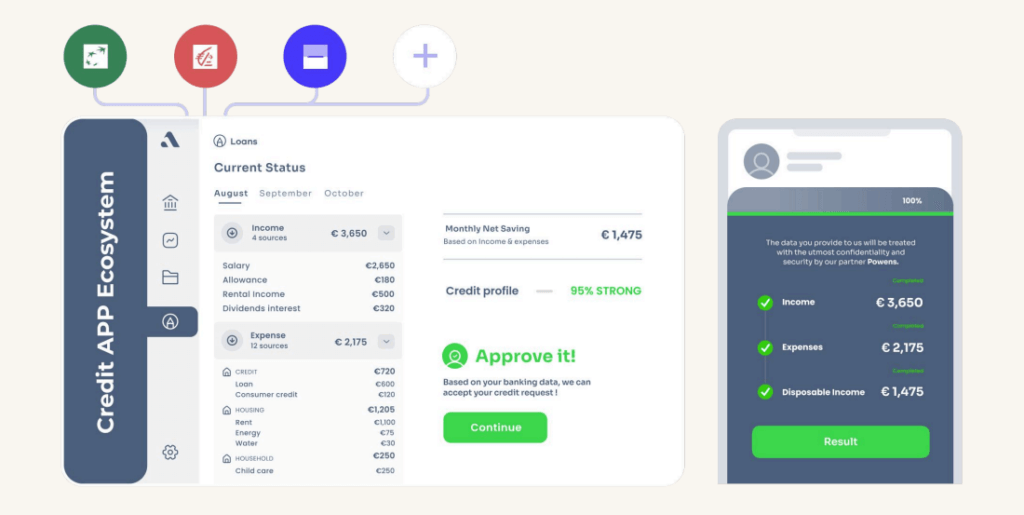

We’re enhancing our Open Banking services with new transaction indicators in France to help businesses make faster, more informed credit decisions. It allows precise insights on a user’s financial situation and behavior (e.g. to better identify regular transactions like rent and salary, to accurately measure their financial capacity).

These indicators, such as income, expenses, balances, recurring transactions, and spending patterns, help businesses assess financial health, detect risks like gambling activity, and prevent fraud.

Want to be the first to try out the free preview of our Indicators?

👉 If you are a customer, ask your KAM to activate this feature. If you are new to Powens solutions, contact us here.

Expanding Bank Coverage and Data Retrieval

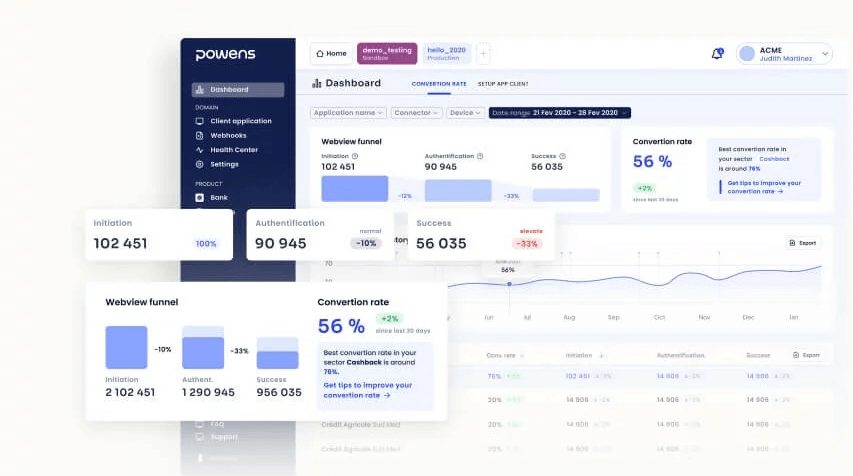

Bank, our bank data aggregation solution, provides instant access to detailed balances, transactions, and historical data from current accounts, fully normalized for seamless integration. We’re enhancing this service with new connectors and improved data retrieval capabilities:

TradeRepublic Checking Accounts Now Available

As of Q1 2025, Powens is among the first providers to connect to TradeRepublic, despite its lack of an official API. This new capability enables access to checking accounts, giving our customers deeper insights into their users’ financial data.

Retrieving additional transaction data

Through Bank, our banking data aggregation solution, our B2B customers can now retrieve and analyze even more transaction data from these three French banks in professional accounts:

- LCL

- Caisse d’épargne

- BNP Fortis

You can access both the main transaction data (i.e. payment amount, date, etc.) and the additional information provided by the bank, such as invoice references.

This data helps us contextualize each transaction and provide richer data, making it simpler for you, for example, to link payments to invoices. As a result, this means more time saved and fewer reconciliation errors.

Latest updates on our payment solutions

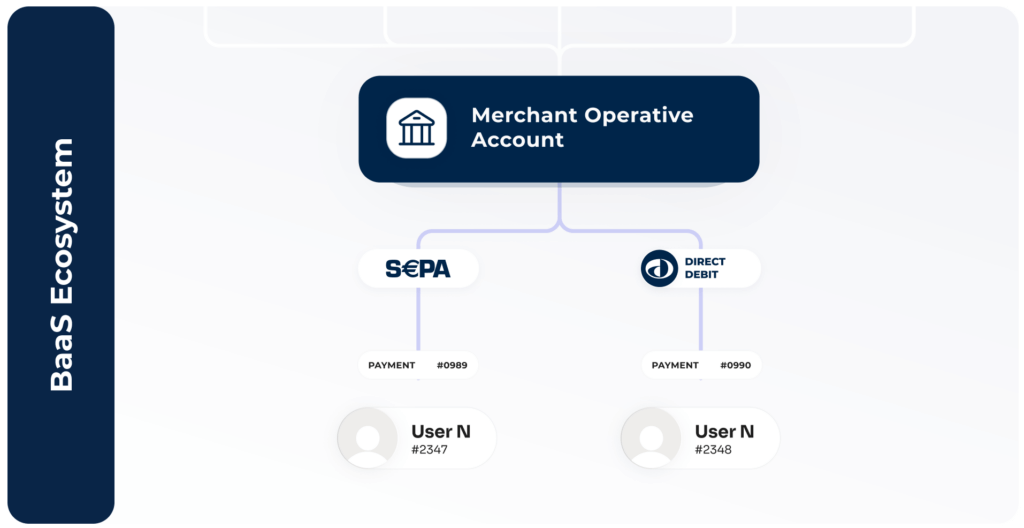

Greater Flexibility for SEPA Direct Debits

Clients using Powens’ IBAN accounts will now have more flexibility when being debited through SEPA Direct Debits. If there are insufficient funds at the time of collection, the debit will not be immediately canceled. Instead, it will remain pending, allowing funds to be added within 3 to 5 days for successful processing.

This added flexibility helps:

- Reduce failed payments due to temporary insufficient funds

- Improve cash flow management, giving more time to ensure account balances are sufficient

Full SICT scheme service

Powens Q1 2025 product release features upgrades to the Bank solution, fraud tools and preparations for CCD2, new payment capabilities, and improved compliance.

We have officially connected to Iberpay, Spain’s clearing house for SEPA Instant Credit Transfers (SICT), enabling:

- Faster, more efficient SEPA instant payments with 24/7 instant access to funds

- Greater reliability and significant operational improvements thanks to instant connection to the clearing house

- Better system availability clear error reporting via direct access to Iberpay’s system

- Refund requests now available

- Transfers of up to €100K per transaction

- Clients will be able to perform Sepa Direct Debit (SDD), Standard Sepa Transfers (SCT) and Instant according to their needs

Go full steam ahead with Powens

Take full advantage of our latest products, features, and capabilities. Whether you’re a new client or an existing one, you can implement the Powens’ products that best suit your business.

Get in touch with our team today

Feb 25, 2025

Feb 25, 2025