The Sellsy scale-up’s billing tool has evolved since it was first created in 2009. Now, it offers a global and collaborative solution combining CRM, management and pre-accounting tools. The benefit for customer companies is to have software that optimizes customer relationship management in a sustainable way over the entire life cycle. Since 2018, Sellsy has used Bank, Powens’ Open Banking product.

The need: design a cash management tool embedded within Sellsy

Sellsy’s tool has added new features over time to address needs that go beyond corporate billing.

Corporate customers had a dual requirement:

- Get a global view over their bank accounts without having to exit the solution

- Avail of an integrated cash management tool

Sellsy teams therefore wanted to link up customers’ accounts to enable CFOs and managers to access a global view of their transactions. The possibility of carrying out bank reconciliation is possible by accessing this view.

How did Sellsy address this requirement? By using business bank account data aggregation, made possible by Powens’ Bank product.

The solution: business banking data aggregation

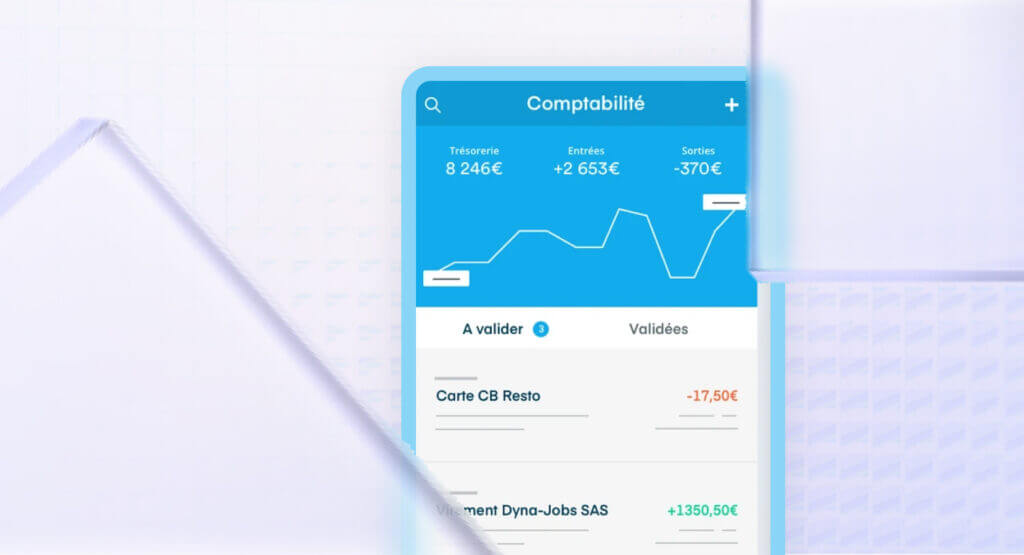

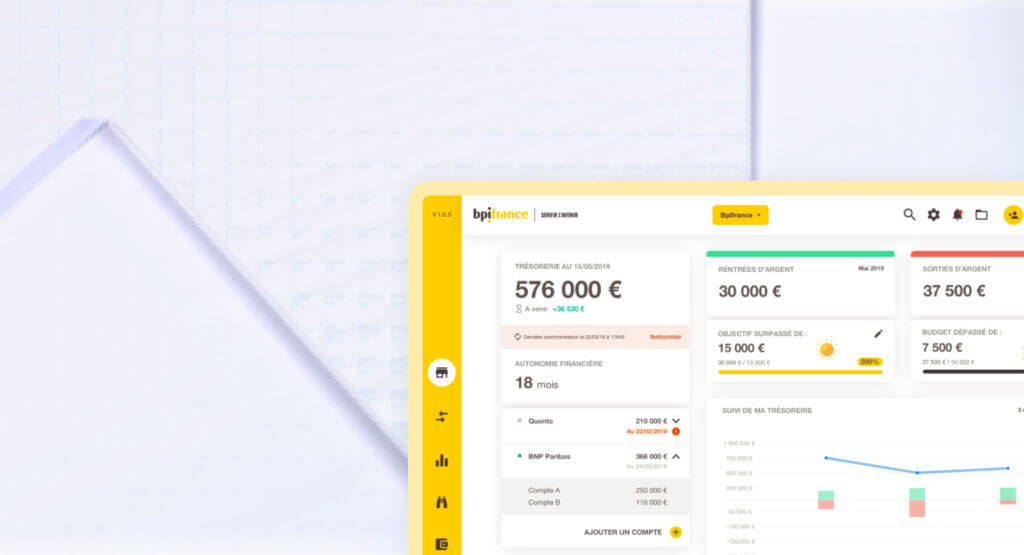

Sellsy offers a cash management tool as part of its suite that uses customer companies’ bank account data.

With bank synchronization, managers and CFOs link up their accounts very simply to the Sellsy interface. They then have a consolidated view of their transactions in real-time without having to log out of Sellsy.

The Bank product also makes bank reconciliation possible, which then can be used by both accountants and sales administration departments. It is now easy for sales administration departments to ensure suppliers are paid and sales invoices collected.

“We chose to work with Powens for the very good relations we have with our contacts at Powens, for their powerful technology tailored to our solutions and solid in-depth knowledge of corporate management and accounting.”

Clément Deschamps, Product Marketing Manager, Sellsy

The results

Figures: 2022

- 6 to 7 hours saved by clients on processing, monthly

- Up to 70% of costs cut for clients

- €10.5 million aggregated by Powens

- 6,000+ customers

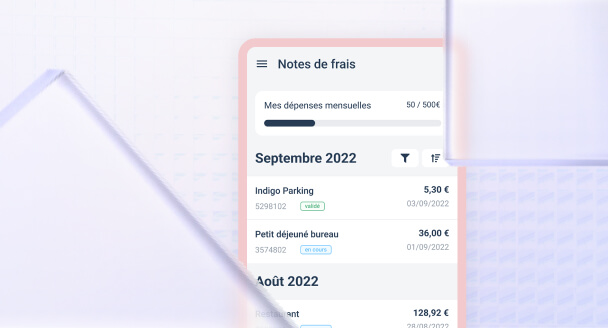

The Sellsy suite delivers 3 major benefits thanks to the possibilities provided by banking aggregation:

- Significant time savings on accounting processing

- Bank reconciliation: 42% of customers use bank reconciliation, making accounting less tedious and much faster

- Control over expenditure: with the bank reconciliation reporting features, customers get an overview to analyze their income and expenses and identify significant levers for savings.

Sellsy is planning to further upgrade its CRM suite so as to enable businesses to continue to grow in an agile way. The team is looking in particular at such features as invoice collection and one-click supplier payments.

Want to boost your management solution?

Schedule a demo

Oct 18, 2022

Oct 18, 2022