Over-indebtedness has reached a critical point in France. In 2024, 134,803 cases were filed with local over-indebtedness commissions across mainland France, marking a 10.8% increase compared to the previous year (source). Behind these alarming numbers are often hidden human stories: families overwhelmed by unavoidable expenses, unforeseen events that disrupt financial stability, and a glaring lack of financial education.

Despite the essential need for effective budget management, too many French citizens lack the tools and knowledge to properly plan and structure their finances. Budget education remains a blind spot in public policy, leaving many households vulnerable to financial insecurity.

In response, CRÉSUS, a longstanding advocate for individuals facing over-indebtedness, and Powens, a leader in Open Banking, have teamed up to offer an innovative and practical solution: Budget Grande Vitesse (BGV).

Designed to make budget education accessible to all, this app combines social expertise with cutting-edge technology to help people regain control of their finances and avoid critical situations. BGV is more than just a budgeting tool; it aims to provide citizens with educational solutions to build a more inclusive and responsible financial future.

Coinciding with the Financial Education Week in France, taking place from March 17 to 23, 2025, CRÉSUS and Powens are unveiling BGV, a groundbreaking initiative aimed at transforming household budget management and empowering individuals with the tools for sustainable financial independence. The app will serve as a key resource in the fight against over-indebtedness, offering practical and educational support to those who need it most.

An Alliance Between Social Expertise and Financial Technology

For over 35 years, CRÉSUS has been supporting individuals facing financial hardship and preventing over-indebtedness through a network of 27 associations across France, mobilizing 500 volunteers. Each year, the association provides assistance to more than 20,000 households, offering tailored solutions and personalized advice. Its expertise extends beyond remedial support: CRÉSUS has developed a prevention and budgeting education activity to combat the lack of understanding of financial mechanisms, an issue that remains a major challenge in France.

On the other hand, Powens has established itself as a leader in Open Banking, providing innovative technological solutions to streamline the banking experience for both individuals and businesses. Its expertise enables the seamless integration of banking data to automate and optimize financial management.

This partnership is based on a human encounter and a strong complementarity: CRÉSUS’ commitment to social support and Powens’ technological capacity to offer innovative, scalable solutions.

Budget Grande Vitesse: A Key Tool for Preventing Over-Indebtedness

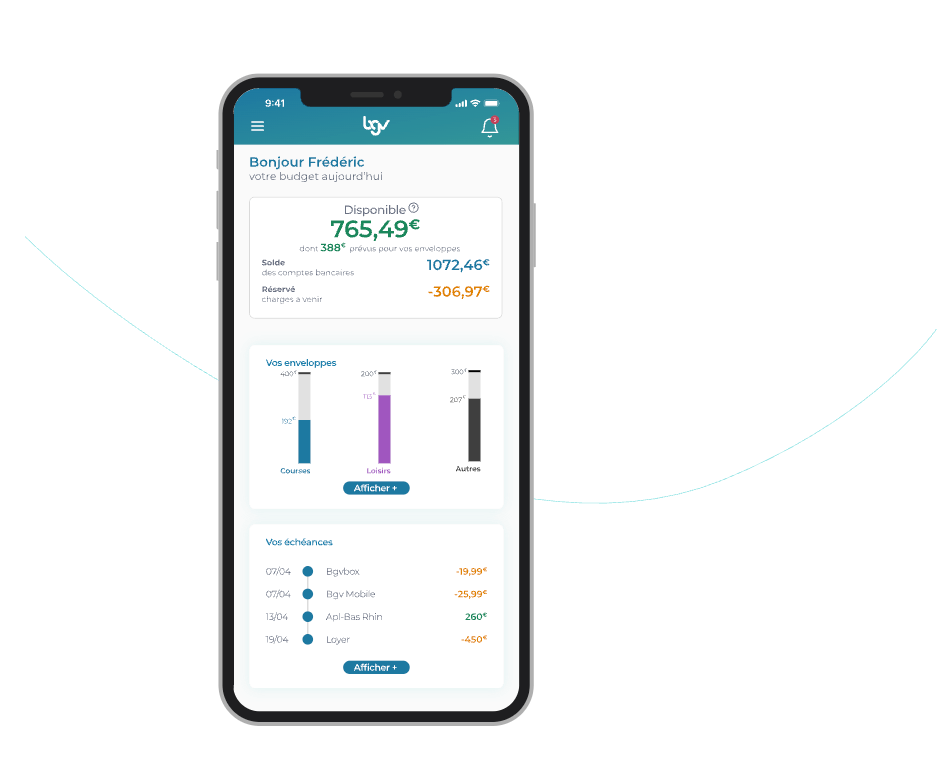

The BGV app aligns perfectly with CRÉSUS’ educational mission. Created to address the gap in budget education in France, BGV is more than just a budgeting tool. It helps users structure their finances and understand their budgets, guiding them step by step toward more manageable and secure financial practices.

Key Features of BGV:

- Connection to Bank Accounts: Upon first login, users can link their bank accounts, allowing BGV to retrieve three months’ worth of transaction history.

- Identification of Fixed Income and Expenses: The app suggests categories for fixed income and expenses, helping users calculate their available monthly income.

- Budget Organization by Envelopes: Users can allocate funds to various categories like shopping, leisure, and daily expenses.

- Real-Time Balance Monitoring: BGV syncs with users’ bank accounts daily, providing a clear view of the available budget (amount that can be spent or saved immediately without risk of non-payment).

- Automatic Expense Categorization: Transactions are automatically categorized for easy, accurate budget tracking.

- Preventive Alerts: Notifications alert users about potential overdrafts or late payments, allowing them to react quickly.

- Access to Social Benefits: BGV includes a benefits simulator, pre-filling information to help users determine eligibility for social benefits.

Security and Privacy

BGV is a 100% French, non-profit application. Users’ personal data is securely protected, never sold, and remains solely under their control. Confidentiality is ensured through Powens’ expertise as a leader in banking aggregation.

A More Responsible and Inclusive Financial Approach

This initiative reflects Powens’ commitment to integrating social responsibility into its business model. In a sector where technology is often seen as detached from social realities, this collaboration proves that innovation can serve a public good.

CRÉSUS, in turn, leverages Powens’ technological expertise to broaden its reach and enhance its efforts while remaining focused on its core mission: to support, prevent, and educate.

Ambitious Goals and a Promising Future

This collaboration is just the beginning. Future developments include an even deeper integration of Powens’ functionalities, in particular with solutions for issuing certified budget reports, further facilitating access to inclusive offers such as assisted personal microloans or specific public-interest aid. The goal is to offer ethical financial solutions tailored to user needs, while reinforcing preventive measures against over-indebtedness.

In an economic environment marked by persistent inflation and rising uncertainty, this partnership offers a tangible solution to a pressing social issue. CRÉSUS and Powens are proving that technology and social commitment can coexist, demonstrating that innovative tools can be harnessed for public benefit.

Full interview here:

More information:

The BVG app : https://www.bgvapp.com/home

Powens

Web : https://www.powens.com

Linkedin : https://www.linkedin.com/company/powens

CRÉSUS

Web : https://www.cresus.org

Linkedin : https://www.linkedin.com/company/assocresus/

Mar 19, 2025

Mar 19, 2025