The fall air may be cooling, but we’re heating up for our next release of new products and features! Check out our latest innovations in Open Finance and Embedded Banking.

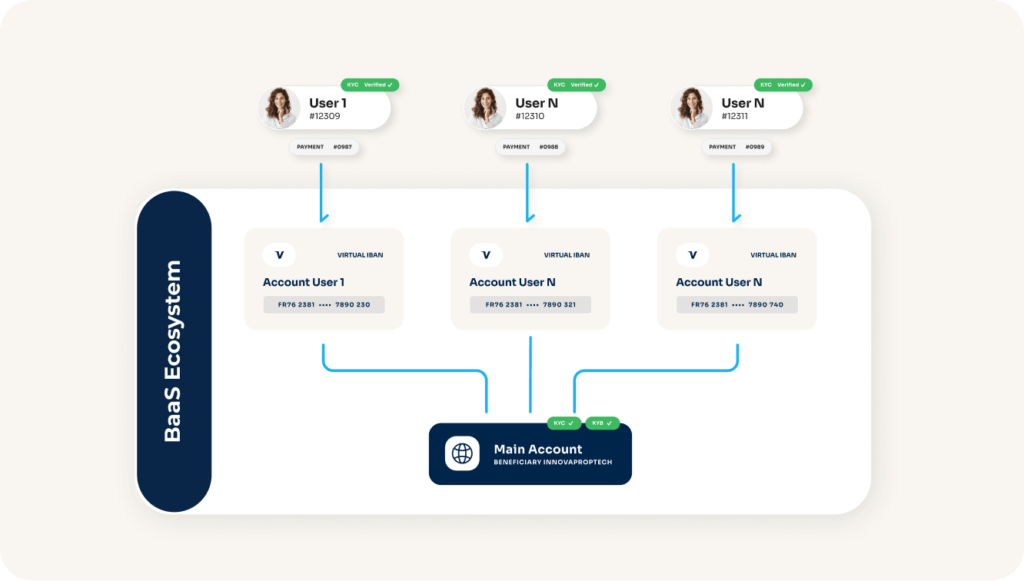

Virtual IBANs revolutionize reconciliation: Powens’ new Embedded Banking capability

Available for spanish IBANs

We’re expanding our IBAN capabilities.

Virtual IBANs are unique digital bank account numbers. While standard IBANs correspond to one bank account, multiple virtual IBANs can exist at once and all connect to a single pooled account.

With the virtual IBAN solution, you can:

- Streamline payment management

- Automate reconciliation processes

- Enhance operational efficiency

- Simplify payment tracking

- Reduce errors in payment processing

- Increase visibility and control over financial flows

Virtual IBANs are specifically designed for managing high transaction volumes. Businesses like real estate firms, Fintechs, accounting software providers, and large enterprises can benefit the most from leveraging this new solution.

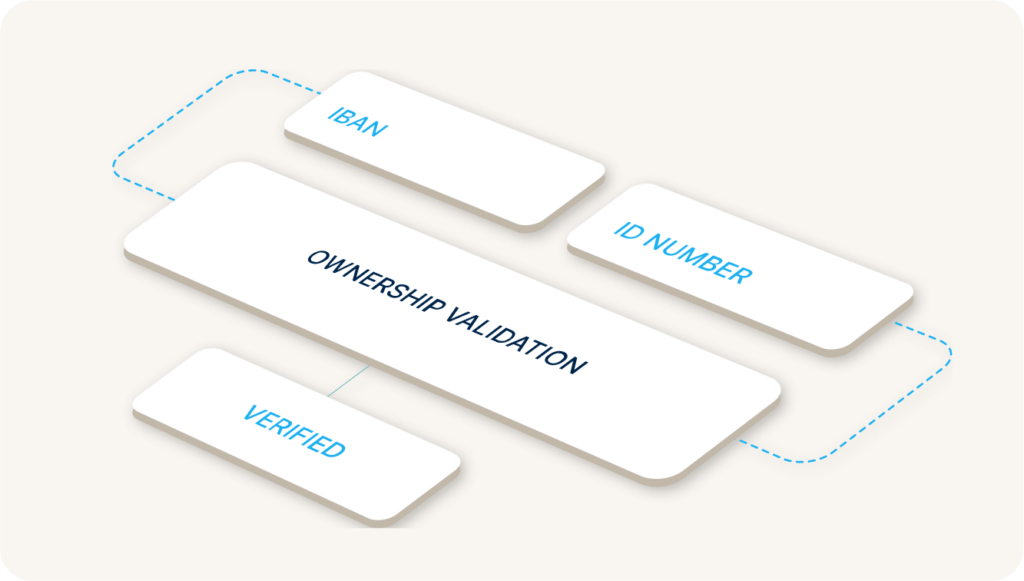

Account Check gains new account ownership verification features

Our Account Check solution allows clients to seamlessly and automatically identify bank account ownership. Now, we’re introducing new Account Check capabilities for both France and Spain:

Joint account readings via Open Banking

Available in France

Clients can now verify the identity of co-jointed account owners, making Powens the first provider on the market to offer this capability. We developed this new feature for companies managing payments that involve multiple bank accounts, such as Buy Now, Pay Later clients, or banks offering shared accounts.

How it works: Powens verifies the identity of each party with a role system that defines who has which type of access to the account. With this new feature, you can streamline corporate cash management and accounting in the context of high and increasing interest rates.

Account check via IBERPAY

Available in Spain

Clients can now validate account ownership with Spanish IBANs without the need for direct user interactions. We’ve designed this feature to process requests more simply and efficiently when confirming ownership of end-user accounts for services like micro-loans and payment authorizations.

How it works: The Powens API connects directly with IBERPAY, the Spanish entity that manages the National Electronic Clearing System. Our API digitally matches and checks IBANs to their owners in real time, allowing for seamless authentication and authorization. Plus, the API can integrate directly with back-office systems like CRMs, ERPs, and TSMs, and allows you to check either individual or batch queries.

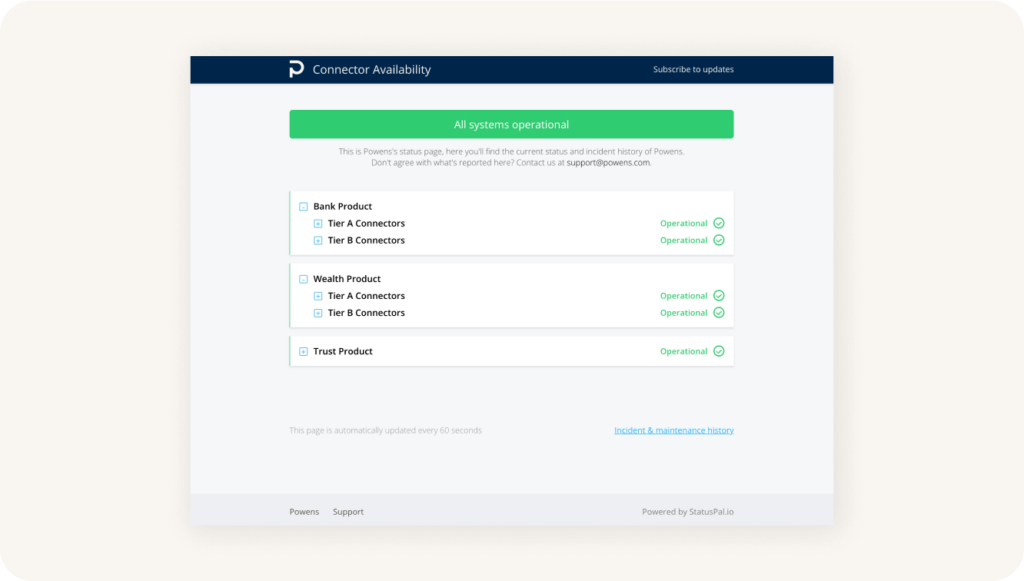

Console updates: Optimizing customer experiences & technical operations

Available for all clients by the end of Q4 2024

The Powens Console gives you the freedom to effortlessly build tailored Open Finance experiences and fine-tune your APIs.

To enhance our Console capabilities further, we’re introducing two new page updates:

Connector Performance

The Connector Performance Page allows clients to monitor the success rate of each connector over the last hour, day, and month. With this page, you can view the percentage of end-users who succeed at connecting their accounts with specific connectors, aiding in optimizing end-user journeys.

From an operational perspective, the Connector Performance Page allows you to optimize customer experiences and communicate more directly with our support and product teams when working to improve conversion rates.

Incidence Report

The Incidence Report Page enables real-time monitoring of incidences, including their current status. With this new page, clients using aggregation services can view all incidents from a single hub, simplifying the technical monitoring process and bringing greater fluidity to Powens’ support services.

Clients will also be alerted by mail, Slack, or another channel of the incident status and will receive verification of the work Powens is doing to resolve them.

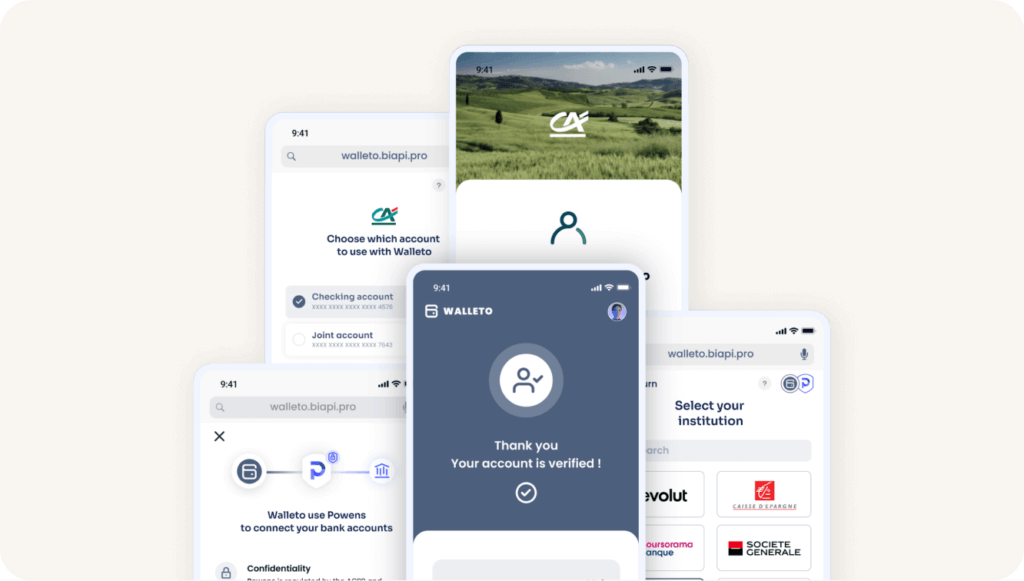

New Webview features to improve mobile & desktop experiences

Available by the end of Q4 2024

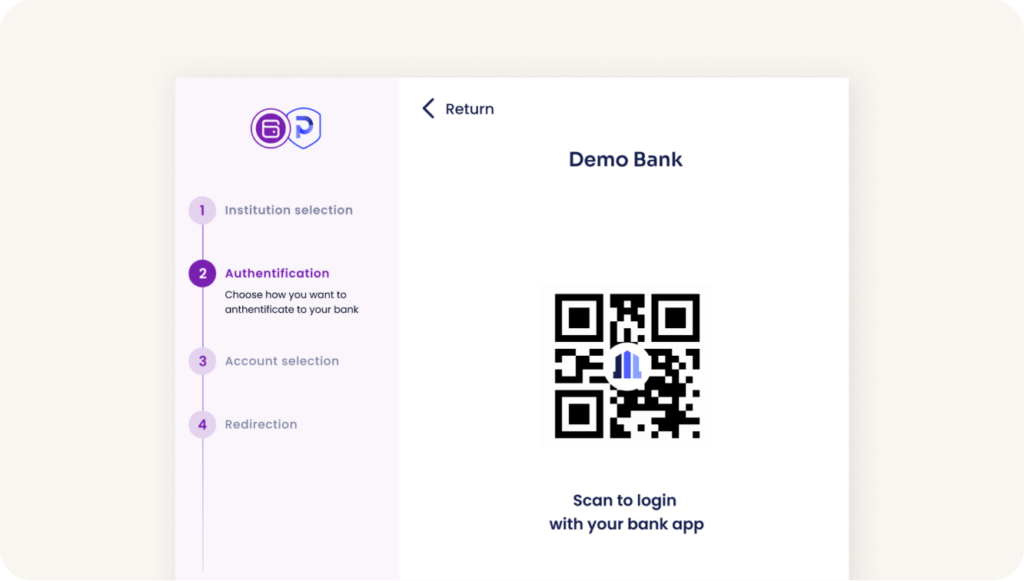

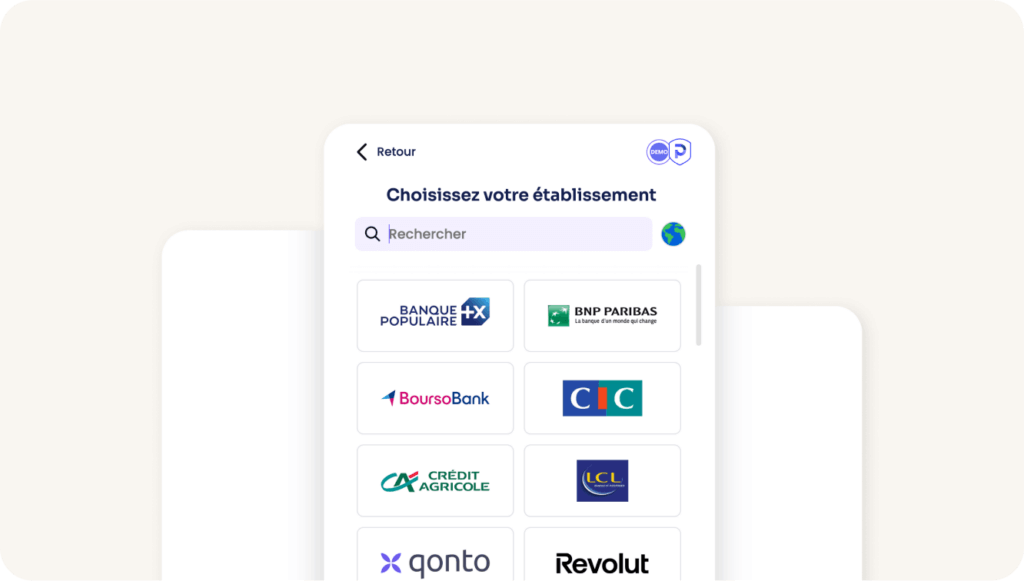

Webview gives you a custom interface to allow your users to add and configure accounts securely. To simplify payment processes via Payment Initiation Services (PIS), we’ve introduced two powerful new features:

- QR code payments: Webview’s desktop features can now generate QR codes that allow end-users to continue the payment process on their mobile devices. These QR codes can easily be scanned with a smartphone to access a bank’s mobile app interface. With this new feature, end-users no longer need to navigate their bank’s desktop interface, remember logins, or manually enter credentials.

- Embedded pop-up flow format: Webview desktop connection flows can now leverage an embedded pop-up that keeps end-users on the clients’ platform. The addition of this new feature prevents disruptions to the flow if a tab is closed mistakenly, which ultimately reduces the risk of end-users leaving and optimizes overall conversion rates.

Powens Connect SDK enables API connections to iOS Apps

Available in France

The Powens Connect SDK is an integration kit that simplifies the process of embedding our Webview into a mobile app. With this new integration, you can implement aggregation journeys and integrate the Powens API into iOS applications –– all without worrying about managing the Webview opening process or creating a permanent user.

Read more about how to install this new integration.

Embrace the opportunity of Open Finance & Embedded Banking

Powens provides you with an impressive array of products, solutions, and features to take full advantage of Open Finance and Embedded Banking technologies.

Designed for financial institutions, Fintechs, and software vendors across Europe and LATAM, the Powens platform gives you the capabilities to optimize your operations with automated banking and payment experiences.

Speak with us today to get started.

Nov 05, 2024

Nov 05, 2024