Equipping you with essential data to take your business to the next level

Even superpowers get upgrades, so we’ve been hard at work supplying our solutions with enhancements, including some you won’t find anywhere else. Discover the latest features of our product line.

Check: A European-wide solution granting key insights to accounts

Our Check solution launched in Q4 2022 with great success. Clients were quick to adopt the product as a means to retrieve account ownership and identifications. This allowed for automating processes and reducing risks.

We are now building upon these primary functions to offer clients more of the information that they need to supercharge both customer and supplier onboarding. This involves understanding what the data are used for.

Our complete solution now offers:

- The label of the account

- The role of the user granting account access

- The type of the account (Personal or Business)

- The account scheme name (IBAN, BBAN, etc.)

- The identification number of the account

Let’s unpack a key aspect a bit further to get an idea of what this means.

Check can now see the role of the user granting access to their account, but this is contingent on the data retrieved by the bank. If a bank grants access to retrieve all parties, Check can see if an account has one or multiple owners, which is important for several reasons. One example would be the case of lenders and borrowers. Of course, lenders abide by different rules of risk depending on the type of account to which they are transferring funds, and from which they are debiting reimbursements. With Check, lenders can see if they are sending money directly to the borrower’s account or an account with multiple users.

This also has major implications for payments. Our model for Check can assist institutions that offer automatic payments (such as SEPA) to see the number of authorizations required according to the number of users. Immediately knowing the number of users lets clients prepare for additional approvals, or keeps clients from going through the hassle completely.

These are just a few examples of how our Check solution is evolving. But that’s not all. Having more features gives us more opportunities. We are pleased to announce that Check is ready for deployment in more countries! First deployed on the French market, the latest iteration of Check can now be implemented at the European level. We’ll have more information on this in the weeks to come!

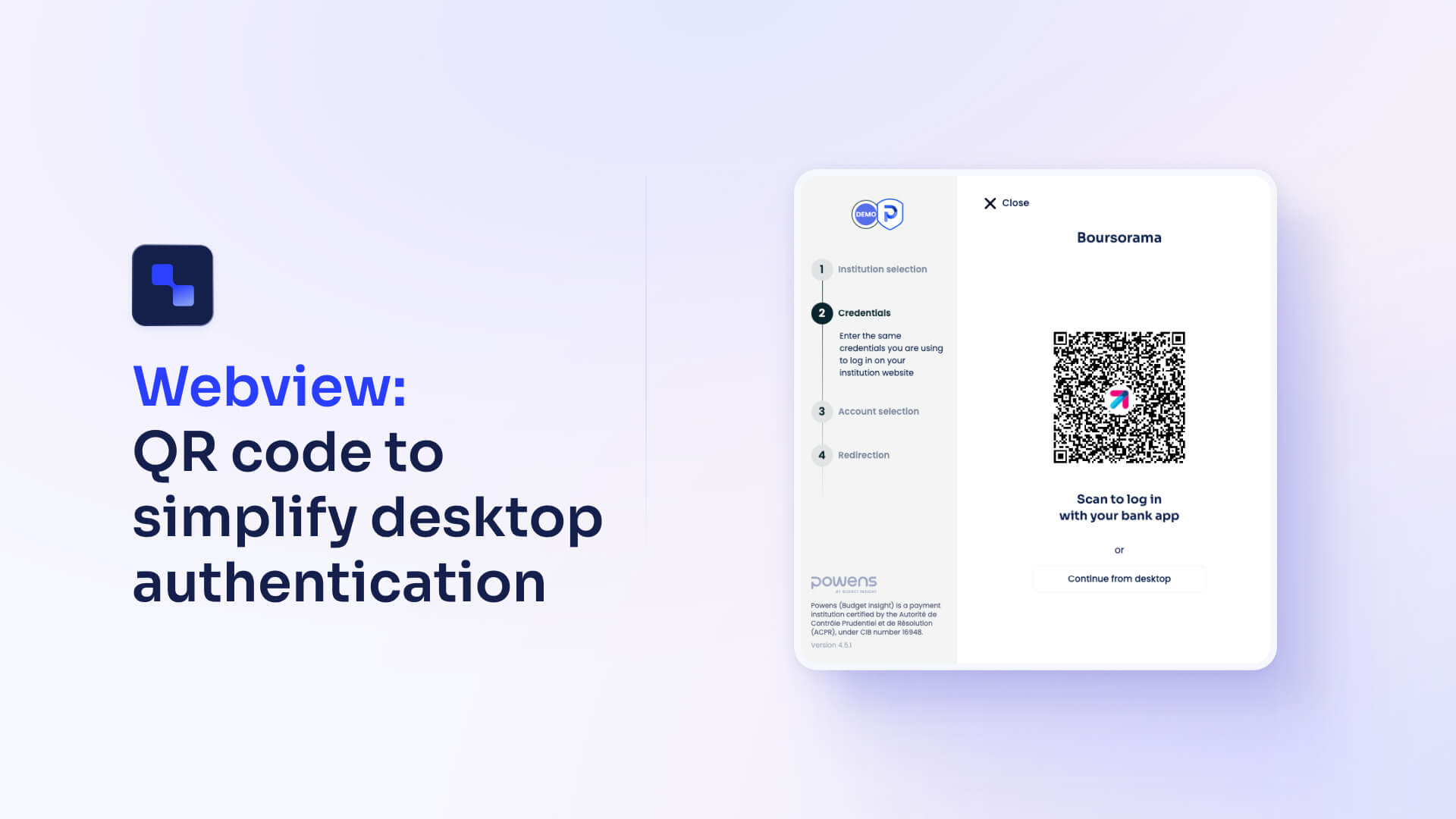

Webview: QR code to simplify desktop authentication

We knew that users’ open banking authentication performs better when it’s done through the bank’s mobile app (“Web 2 app” or “App 2 app” flows). Recent analytics show that this trend is increasing and that user authentication on bank mobile apps now significantly outperforms desktop authentication. A person is 20 percent more likely to complete authentication when using a mobile device.

To allow users authenticating from desktop browsers the same experience as mobile users, we have introduced QR codes on desktop. Users can now seamlessly start their journey on desktop and continue it on mobile.

Carrying over the authentication to mobile devices simplifies the process in two major ways. First, of course, by allowing users to continue the process while moving about. Second, and here’s what’s interesting, since many passwords on mobile are unlocked using biometrics and one-for-all passcodes, transferring the customer journey allows users to continue the process without having to remember all the credentials required on desktop. Say “goodbye” to the old-school way of logging in and say “hello” to a smoother, more efficient customer experience!

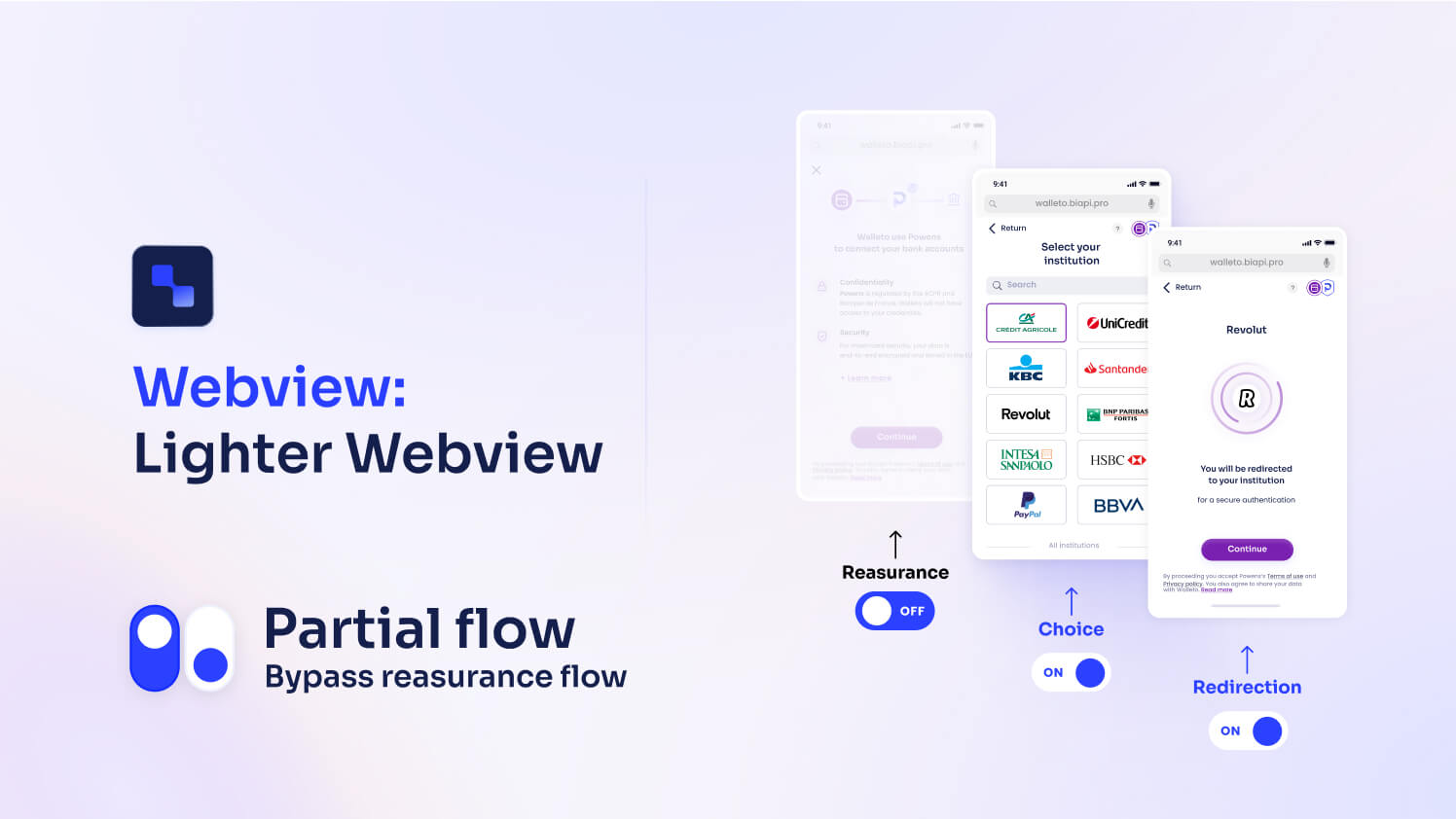

Webview: Lighter Webview

Streamlining processes has a great impact on user conversion. In continuing with our mission to analyze trends and adapt accordingly, we noticed that certain customer use cases had a significant “user dropoff” on our Webview just before the list of accounts to connect to were displayed. To address this, we have launched an option allowing customers to activate a lighter version of our Webview.

What does this mean? As you recall, there is a page just before customers connect that serves to reassure them that everything is secure and follows compliance. This notification had noticeably become a hurdle for some. To get them over that hurdle, you now have the option to deactivate this notification, moving customers directly to the following connection page.

We activated the new feature at the beginning of the quarter, and we have already seen a measurable reduction in user dropoff.

Every little bit counts, and implementing this feature is another example of continuing our commitment to simplify processes for your and your users.

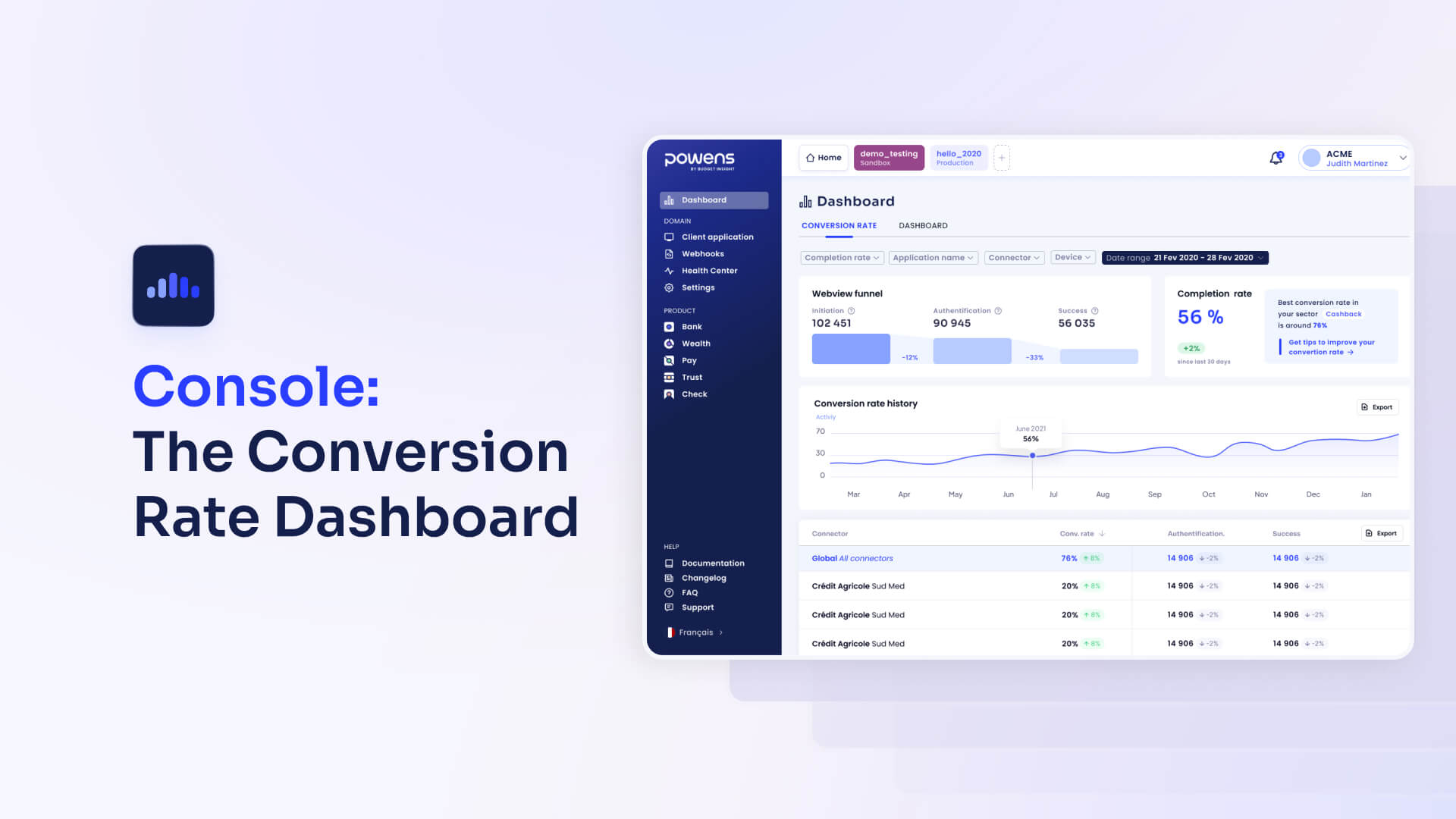

Console: The Conversion Rate Dashboard

In real estate, they say what matters most is the physical location. Their mantra is “location, location, location.” We know that for our clients, digital location is what matters. This means getting customers from one place to another along the customer journey. Our mantra is “conversion, conversion, conversion,” and this is the end goal of having a QR code for desktop authentication and a lighter Webview.

Since we’re progressively introducing new ways of improving conversion rates, we thought it was the right time to give our clients the ability to track and analyze Webview conversion rates and see whether their changes impact them.

Meet the Console’s new Conversion rates dashboard; where you can now see the initiations, authentications, and the success rate of Webview user journeys. This tool will feature the success rate of each user, which you can break down by bank to see which institutions have a higher conversion rate of success among their clients.

Wrapping up

Our latest superpowers are the result of a team effort between you, our clients, and a formidable team here at Powens. We will continue to listen to your feedback, analyze data, and deliver solutions that further the Open Banking revolution.

Jul 17, 2023

Jul 17, 2023