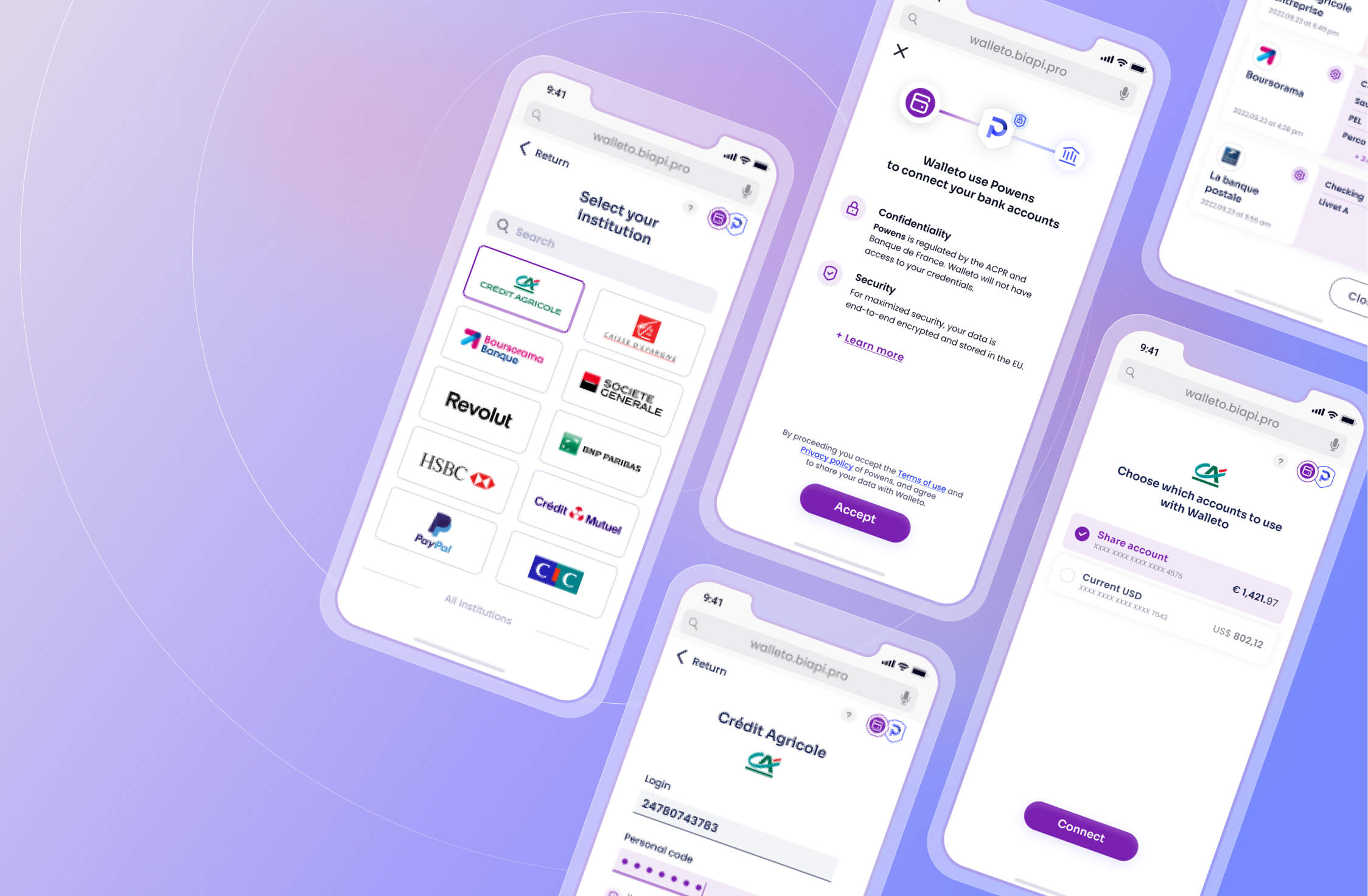

Our Webview, the login and payment interface for end-users, has been completely redesigned to simplify their experience and give them full confidence. Discover V4 now!

Reminders about Webview

Our mission is to deliver the best Open Banking and Open Finance experience to businesses and their users.

To businesses, we promise an enriched API that is easy to integrate and performs well.

To their users, we guarantee an ever more secure, simple, and trustworthy connection path. This commitment is supported by Webview, the login and payment interface for users. Through Webview, users can send a transfer to pay a merchant or to fund a wallet, connect their bank accounts to an application, or allow a management tool to collect their invoices or administrative documents.

This way, they give their consent to Budget Insight to carry out these actions on their behalf. This interface is therefore of strategic importance: in addition to being easy to use, it must give the end-user confidence and reassure them of our ability to manage the security of their data from end to end.

Why a new version?

We are committed to advancing Open Banking and Open Finance and to promoting the values of openness, transparency, and innovation of this movement. That’s why we pay a lot of attention to the user experience: we analyze data and work to improve our screens.

The deployment of V4, a completely overhauled version of the Webview, marks a crucial step in this continuous improvement process.

Invested for 10 years in the success of our 250 clients, our rich experience in Open Banking and Open Finance leads us to focus on three objectives for the connection paths:

- Reassure and give confidence to the end-users

Even if it adds steps to the journey, users need to be reassured about the legitimacy of our activity (we are a regulated player), the security and confidentiality of data processing.

- Offer a flexible and customizable path

Not all our clients offer the same experience: some budget management applications only offer aggregation of current accounts, while others, specialized in savings and investment, collect passbook accounts, loans, or life insurance. Still, others will offer to initiate account-to-account payments. Each time, it may be a question of different connection paths to be managed in a unified manner.

- Communicate clearly about incidents when they occur

Connection to the accounts may be momentarily dysfunctional on some banks, and for some users only. In this case, we inform users about the instabilities and encourage them to try again later if there are problems.

The 9 new features of V4

1. An improved user path

The user journey steps have been examined from all sides in order to better order them and optimize the conversion rate.

2. Giving confidence in Open Banking

Sharing banking credentials can be baffling. It is, therefore, crucial for us to reassure end-users as much as possible about our legitimacy to process them to enable our clients to provide their service.

We have reworked our messages by indicating the place and role of Budget Insight: a trusted third party approved by Banque de France, intervening between our clients’ solutions and the end-users.

The validation of our T&Cs is now done at the beginning in order to make the process smoother and continuous.

3. Reassure about the security and confidentiality of data

European sovereignty, encryption of sensitive data and respect for the ownership of recovered information are at the heart of our promise.

We emphasize data security and privacy more clearly than ever before. Recovered data, owned by users, is encrypted with methods similar to those used in the banking industry.

All of our clients have control over how long their data is retained – and can delete it on demand.

4. Make it easy to choose connectors

Rather than offering all banking & finance institutions at once, we highlight the connectors that are most relevant to end-users. This list builds and refines as clients use our API.

On average, 80% of connections come from the eight most used connectors on clients’ API domain. Showcasing them first helps narrow the search and improve the experience.

5. Connector stability

Our data synchronization-based system allows us to determine the connectors’ status in real-time. With this feature, we can tell end-users if there is a risk of not being able to retrieve their data.

The goal is to give end-users the opportunity to attempt an addition while preparing them for the possibility of failure. We have set the alert threshold at 5% (the message appears when 5% or more of the connection attempts fail).

6. Animations

Some waiting times are inherent to the connection process to an institution, for example during the retrieval of accounts and during the validation of the users on their banking application.

Animations help reduce the waiting feeling while providing contextual indications of the actions to be taken.

7. “Manage” section

In “Manage” section of our Webview, users can manage their connections (delete connections, activate new accounts, etc.).

They can also update their passwords and perform their SCA (Strong Customer Authentication) every 90 days.

These connection states are highlighted to simplify their resolution.

8. SCA or strong user authentication

Some technical terms can be difficult to understand for some people. We have therefore decided to help them by explaining what strong authentication, or SCA, is.

Here again, it is a strategic issue to guarantee a quality service. The PSD2 directive, which governs our activity, stipulates that the SCA must be renewed regularly. This renewal management must therefore be simplified.

9. A more modern and still responsive design

Because form always has a determining influence on the content, the entire graphic codes of the Webview have been redesigned to offer an aesthetic experience in line with the best current standards. The result is a fresher, more modern, and more airy interface.

And of course, our clients can always customize the Webview with their own design system.

What if you discover all these new features for yourself?

Try out our prototype.

Do you want to activate the Webview on your domain?

- Log in to our administration console

- Select your domain

- Click on “Applications” in the left menu

- Choose a client application and click on “Customize”

- Go to the “DISPLAY” tab

- You can activate our “New Design” which will take effect immediately after saving the changes

Dec 16, 2021

Dec 16, 2021