How to manage widely diversified assets independently? Mounir Laggoune and Julien Blancher were confronted with this problem when investing their own money. Since they could not find the ideal solution, they decided to create it themselves. Using Powens’ cutting-edge technologies, Finary helps customers aggregate all their assets and manage their investments independently.

The need: manage diversified assets, simply

How to manage widely diversified assets independently? How to analyze your portfolio and define an investment strategy independently, without having the required financial culture? How to access alternative investments (crypto-assets, startups) without going through a wealth manager? Mounir and Julien had to ask themselves these very same questions, after their respective exits.

None of the tested solutions enabled simple tracking of diversified investments. When they spoke with other people, they realized that this was a problem for many investors, who had to have recourse to Excel tables to manage their investments. Complex and tedious work.

Finary provides the answers to all these questions with its 100% online tool, which enables users to centralize all their assets and manage their investments more efficiently. Thanks to Powens’ banking data aggregation technology and unique ability to aggregate investment accounts, the platform provides a consolidated global view of all accounts and investments in real-time.

The solution: a one-stop shop that aggregates all investments, 100% online

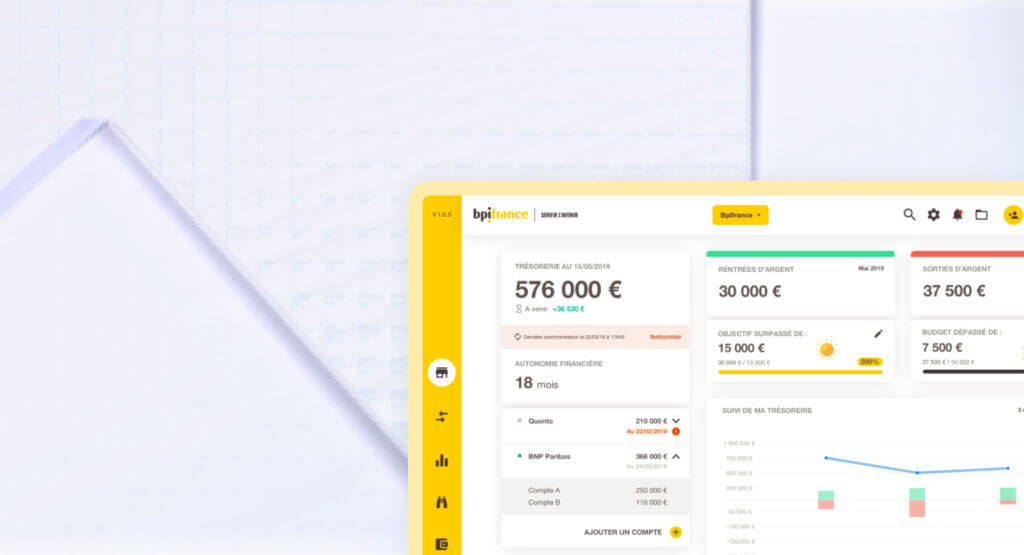

Like wealth managers, Finary is seeking to provide a “one-stop shop” service that is entirely online. The platform gives an aggregated view of an investor’s wealth in real-time: assets, liabilities, and how they fluctuate with movements on financial markets and in the economy generally. This global and dynamic vision of an investor’s assets is supplemented by an analysis layer and recommendations on how to optimize investments.

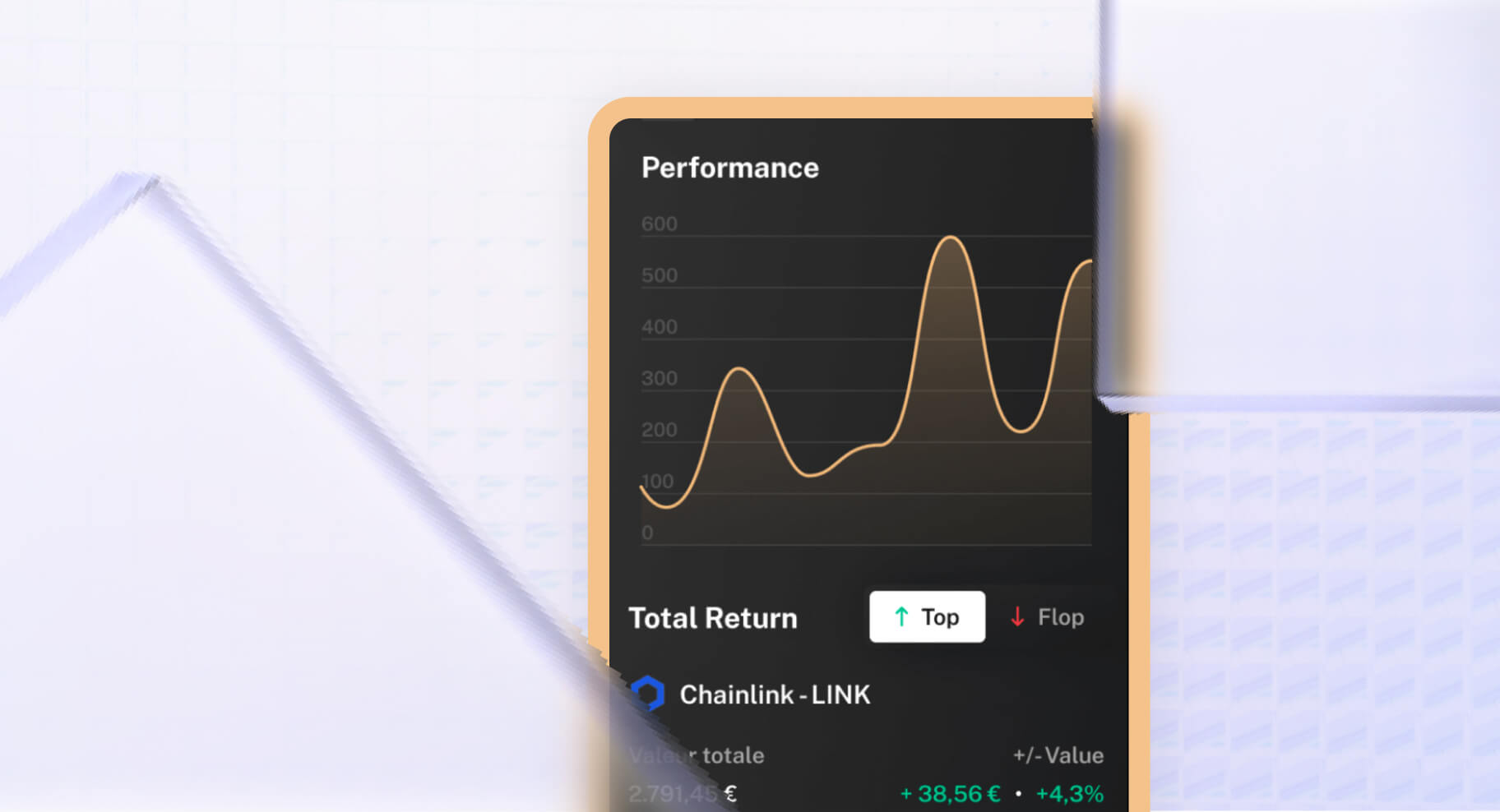

Thanks to Powens’ Bank and Wealth products, with just a few clicks, Finary users can connect their bank accounts and investment accounts (life insurance, PEA and PER plans, etc.). They then get a 360° view of their investments. Finary’s custom dashboards give a clear view of the performance of each investment.

Users also have access to training materials, they can ask questions and get advice on how to define their investment strategy. They are able to make informed decisions, independently.

“We have gone around the market, and Powens is the only player on the market to offer bank account and investment account aggregation. We have access to more than 300 establishments in France and cover a wide spectrum of investment data. Updating data in real-time makes a real difference to the user experience, who can see how their assets fluctuate day by day on the dashboard.”

Mounir Laggoune, Co-founder, Finary

The results

Since its launch in late 2020, Finary has won over investors. In 2022, 30,000 users had joined the platform.

Figures: 2022

- €25 billion in assets tracked

- 25,000 banks and investment platforms available

- 100,000 users

Finary opens up access to tailor-made wealth management, something previously reserved for a small part of the population. The company gives users the knowledge to make the right decisions, independently, based on real-time aggregated data.

The next step for Finary: enable its users to invest directly on the platform. Initially launched in France, the company’s ambition is to become the European leader in online wealth management.

Do you want to tap into the potential of Open Finance?

Schedule a demo

Oct 18, 2022

Oct 18, 2022