Founded in 2021 with a dream to become France’s first crypto-wealth platform, Ledgity’s mission, since day one, has been to build a powerful, innovative, and inclusive tool to help investors and financial advisors prepare for the major savings challenges of tomorrow.

They set out to create a must-have app for buying, selling, exchanging, and storing crypto assets that could also easily aggregate all of a customer’s other wealth sources in one convenient place. At the same time, they wanted to give financial advisors a better and more efficient way to support their clients’ investment activities.

Part of this involved developing solutions to simplify and streamline administrative tasks—like full financial account aggregation, document signing, and form completion—thereby making it possible to visualize a client’s total wealth in real time.

Unfortunately, they couldn’t do full financial account aggregation all on their own. So, they looked to Powens’ Open Finance solutions to fill in that gap. Here’s how.

The Need: The ability to deliver a comprehensive portfolio visualization and wealth management app-based experience

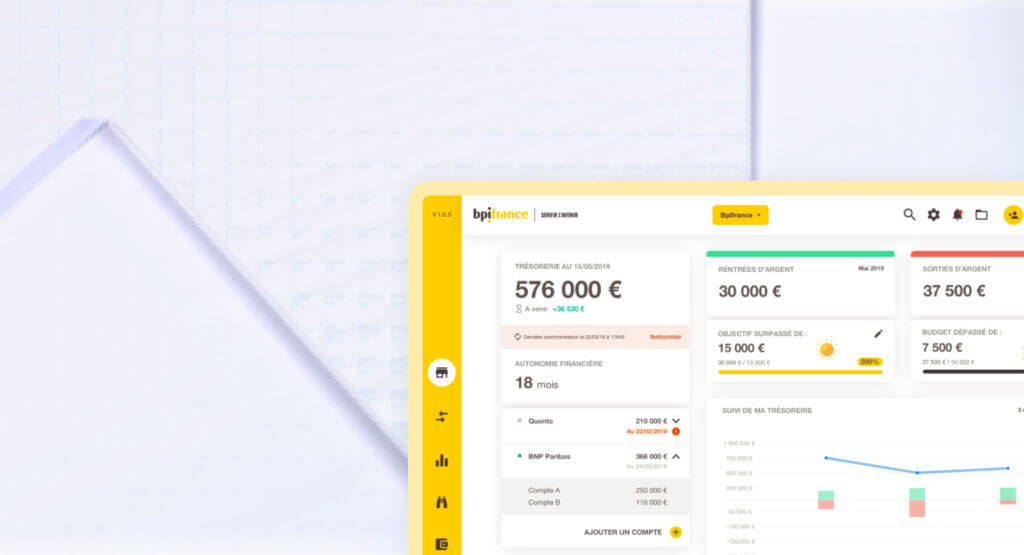

The vast majority of crypto management platforms popping up over the last few years have been purely crypto in scope. What was missing was a comprehensive tool that could go beyond crypto management alone to help investors—and their financial advisors—get a holistic view of total wealth across all active bank (checking and savings), investment, life insurance, and, of course, crypto accounts.

Because the world of crypto is natively API-based, crypto account aggregation wasn’t an issue. Unfortunately, the same can’t be said for the broader wealth ecosystem. To make it possible for Ledgity’s customers to import all wealth account data into the app—and then be able to visualize fluctuations in their wealth in real time—they needed a secure, compliant, and turn-key way to bring this functionality to life, instantly. Powens was the answer.

The Solution: Open Finance for enabling frictionless banking, savings, and investment account aggregation

Thanks to Powens’ Bank and Wealth account aggregation solutions, Ledgity was able to deliver on its goal of helping customers visualize total wealth in real time via the in-app experience. Streamlining and automating wealth account aggregation in this way was essential for Ledgity to be able to position itself as a comprehensive crypto-wealth platform—and stand out from other crypto- or wealth-only players in the market.

The Results: A single, powerful app for keeping track of a customer’s full financial portfolio in real time

Ledgity’s app, available for both iOS and Android, officially launched in March 2023. The feedback from its early users is already quite positive. Many have called out the financial account aggregation feature—including the ease of importing various banking, investment, and insurance accounts into the app—as a key benefit.

They also love that, once their entire portfolio has been imported, it’s easy to share this information with a financial advisor who can then use that data to automate administrative tasks, respond to questions faster, and provide customers with better financial advice.

But Ledgity’s crypto-wealth journey won’t stop there. In the near future, the company plans to unveil “monthly wealth management” statements—a highly visual deliverable, powered by the data from all aggregated accounts, that can be leveraged by investors and financial advisors to drive more sound savings and investment strategies.

This is clearly just the beginning of Powens’ already strong relationship with Ledgity. We look forward to seeing how this collaboration unfolds in the months and years to come.

” The promise of a first-ever crypto-wealth platform wouldn’t have been possible without the help of Powens’ Open Finance solutions. ”

Pierre-Yves Dittlot, CEO and Founder at Ledgity

Tap into the power of Powens’ Open Finance platform today

Contact our team today to schedule a demo of our Open Finance products and services.

May 23, 2023

May 23, 2023